ISLAMABAD (Reuters) -Pakistan's finance minister vowed on Tuesday to persevere with plans for new taxes on the retail sector despite strike threats, as a step towards winning approval from the board of the International Monetary Fund (IMF) for a $7-billion loan.

The taxes, in line with ambitious revenue targets adopted to clinch a staff-level deal on the 37-month IMF programme, face public backlash after they were introduced in the June budget.

"One thing I want to be very clear (about) ... This is not going to be taken back," Finance Minister Muhammad Aurangzeb said in a televised speech that urged wholesalers, distributors and retailers to contribute to the economy.

The comments follow a nationwide strike by retailers last week to demand withdrawal of the new tax scheme and high electricity rates, the latest of the last few months' protests against the new tariffs, taxes and inflation.

Although Muhammad Sharjeel Goplani, chairman of a group of traders, the All-City Tajir Ittehad Assocation, had threatened an indefinite strike if the demand was not met, no further action has been announced since.

Pakistan was in the advanced stages of securing the IMF board's approval, Aurangzeb said, after having said last month that it was expected in September.

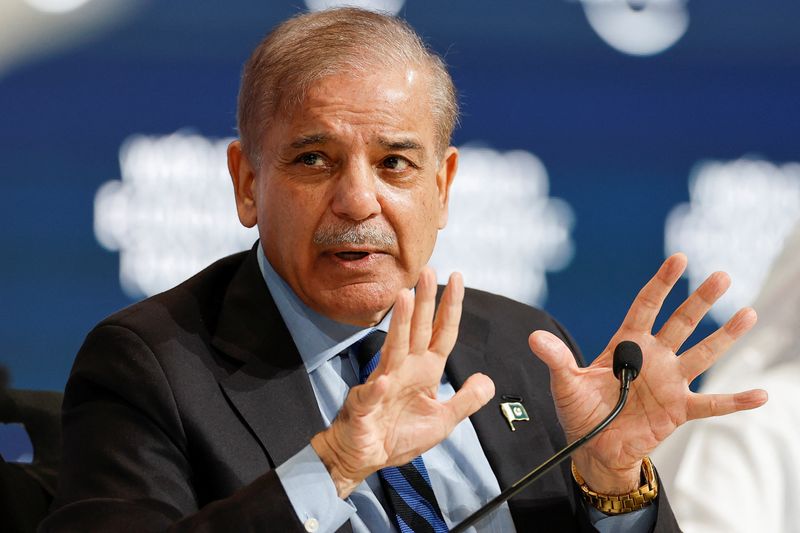

On Tuesday, Prime Minister Shehbaz Sharif said the government was working to adopt IMF conditions and complete a loan programme he hoped would be the South Asian nation's last.

The Fund's board approval hinges on confirmation of financing assurances for Pakistan from development and bilateral partners.

Media said the approval was delayed by a lack of additional financing and unpaid energy sector subsidies announced by the eastern province of Punjab and the federal government.

In a statement, Punjab's information minister, Azma Bukhari, said the federal government and the IMF had not contacted the province about an electricity subsidy and the Fund had not released any written statement.

The IMF, the finance ministry and the power ministry did not immediately respond to a request for comment.

Reining in unresolved debt across Pakistan's power sector is a top concern of the IMF, which ended a $3-billion bailout in April that led to higher tariffs, hurting the poor and middle class, and cut household use for the first time in 16 years.

Moody's (NYSE:MCO), which upgraded Pakistan's rating to Caa2 last week, citing increased certainty on external financing after the IMF staff-level pact, expects board approval within weeks.