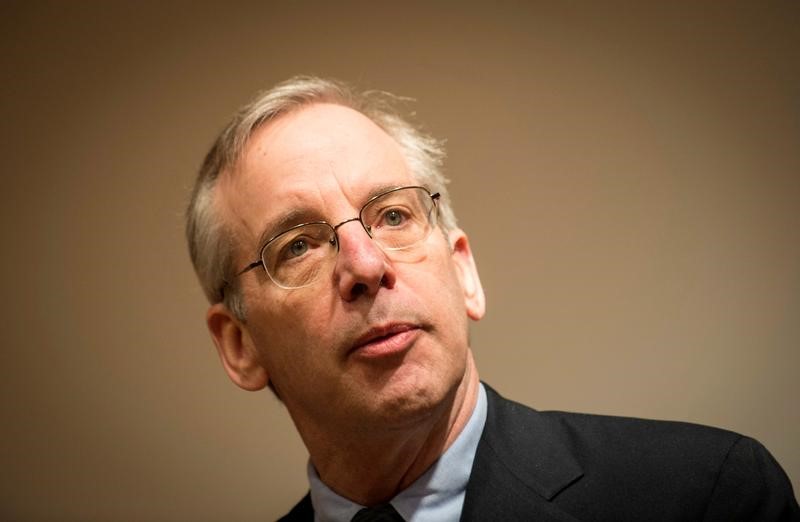

Investing.com – Federal Reserve (Fed) Bank of New York president William Dudley gave an upbeat assessment of the economy on Monday and warned against the central bank taking a pause in the tightening cycle.

Following much the same line of thinking as Fed chair Janet Yellen in last week’s press conference after the central bank hiked rates for the second time this year, Dudley suggested that current levels of unemployment and inflation were a “pretty good place to be”.

In a business roundtable held in Plattsburg, NY on Friday, he stated that he was “very confident” that there is “quite a long ways to go” in the upcoming expansion and felt that the U.S. economy was close to full employment.

Dudley did admit that inflation was a “little lower” than the Fed would like, but said he expected wages to pick up as the labor market continues to tighten.

With regard to the future of U.S. monetary policy, Dudley insisted that “halting (the) tightening cycle would imperil the economy.”

The dollar strengthened on the back of Dudley’s remarks. The US dollar index, which tracks the greenback against a basket of six major rivals, was last up 0.13% at 96.99, compared to 96.86 ahead of Dudley’s statements.

After the speech, EUR/USD was trading at 1.1180 from around 1.1197 ahead of the event, GBP/USD was at 1.2772, compared to 1.2788 previously, while USD/JPY was at 111.26 from 111.05 earlier.

The yield on 10-year U.S. Treasuries also turned around from earlier losses and was last up 0.54% at 2.169%.

Gold futures futures also hit a session low on the remarks at $1,250.12 and was last down $5.43, or 0.4%, at $1251.07. That was compared to $1,252.30 before the comments.