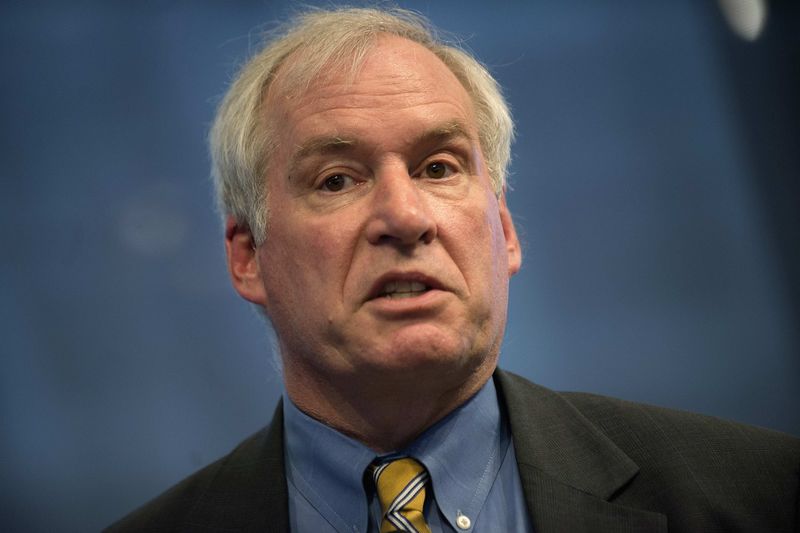

Investing.com - Boston Fed president Eric Rosengren said on Monday that he felt the market was mistaken in its expectations for only zero to one rate hikes this year.

In a speech on the perspectives of risks in Boston, Rosengren clearly stated that the financial market expectations of only a very slow removal of monetary policy accommodation could, in his view, prove unduly pessimistic.

“As I see it, the risks seem to be abating that problems from abroad would be severe enough to disrupt the U.S. recovery,” Rosengren explained.

"I personally expect that a stronger economy, at essentially full employment and with gradually rising inflation, will lead to more tightening than is currently priced into the futures market expectations for the next two years," Rosengren said.

Rosengren was quick to emphasize that his outlook still calls for a gradual pace of increases and that, as always, the path should depend on incoming economic data.