By Abhinav Ramnarayan

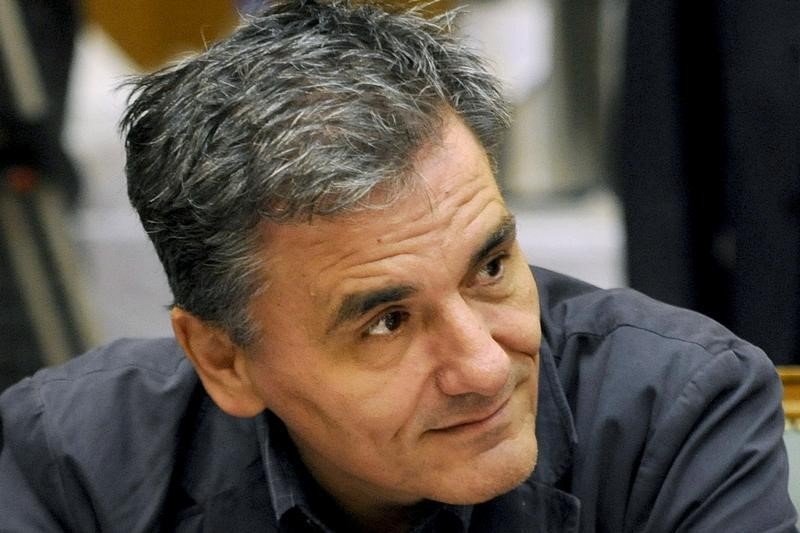

LONDON (Reuters) - Volatility in Italian government debt has made it harder for Greece to return to bond markets, Greek Finance Minister Euclid Tsakalotos told Reuters, but said he is comfortable with waiting for the right time to raise funds.

A recent selloff in Italian government debt has pushed up the borrowing costs of other Southern European countries, including Greece.

But Tsakalotos told Reuters on the sidelines of a conference on Friday that his country's financing needs are under control.

Greece, which exited that last of its bailout programs in August, has agreed debt relief measures with its euro zone partners. These extend maturities on some loans and soften the interest rate burden on others. Athens also has a 24 billion euro cash buffer, which will help to improve debt sustainability over the medium term.

Tsakalotos said Athens would return to the bond market at the optimal time, and played down the Italian bond selloff.

"It has made it a little harder but on the other hand I think markets are now becoming more sophisticated in understanding that Greece has finished its program, it has done a huge amount of reforms, it's got a buffer so that its financing needs are under control for at least 2-1/2 years," he said.

"Also it has got a debt deal that means financing its debt is easier than it is in Portugal and Italy."

Asked if Greece will attempt a bond sale this year through syndication -- where banks are appointed to sell debt directly to investors -- Tsakalotos said he will leave the timing up to Greece's debt agency chief.

"He has instructions from the government that when markets are appropriate, we would like to go. But it's his job to do the research and to tell us when it is the optimal time," he said.

"We're comfortable that we can wait since we have the buffer, but that doesn't mean we won't go when the time is right, and I think the time will be right over the medium term."

Earlier in the year, Athens was believed to be considering a 10-year bond syndication, its first sale in that benchmark maturity since its debt crisis began in 2010.

Since then, Italian debt has sold off as the new anti-establishment government in Rome set out spending plans that put it at odds with Brussels.

Italy's 10-year bond yields (IT10YT=RR) have nearly doubled from 1.72 percent in April to 3.31 percent on Monday, dragging up Greek 10-year yields (GR10YT=RR) from 3.85 percent at the start of May to 4.25 percent currently.

GRAPHIC: Rising Italian yields affect Greek debt - https://tmsnrt.rs/2CLmdNo

ITALIAN TALKS

Even so, Tsakalotos said the European Commission should be understanding when negotiating with Rome over its budget plans.

"Italy is a country whose GDP per capita has hardly increased in the last 20 years and it's also a country with huge regional inequalities," he said. "So it's important that the Commission and member states take into account the Italian situation and try to reach a compromise which would be good for the people of Italy but also for Europe itself."

Asked if Italy should look at an alternative route, he said it was important that Italy stays in the European Union.

"I'm a pro-European for a lot of reasons but a major reason is that I've always feared that if Europe breaks up, it will result into the kind of nasty right-wing populist politics of the 1930s with competitive devaluations, rival nationalisms," he said.

"So I think it's important for European people and for a progressive agenda that we not only avoid that but reform Europe in a way that addresses the real issues people face in terms of social inequalities, the amount of jobs available and the quality of those jobs."