By Sinead Cruise, Lawrence White

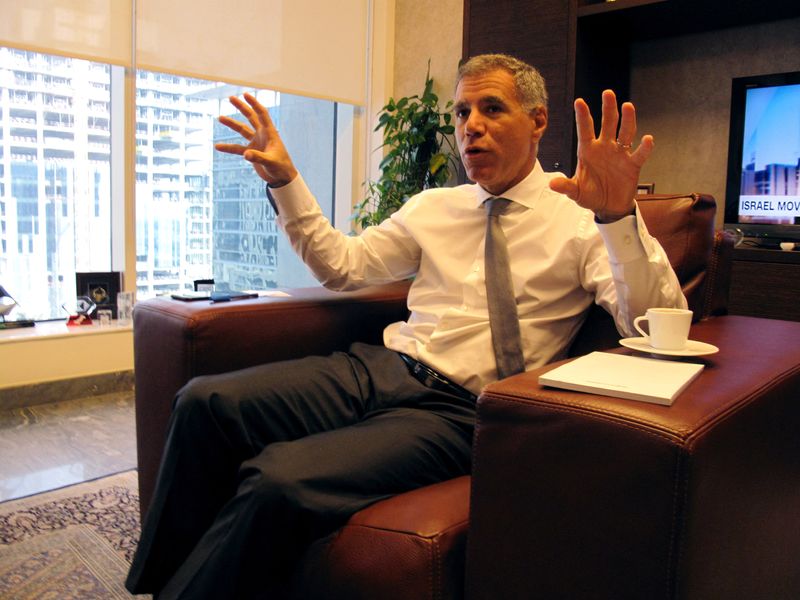

LONDON (Reuters) -When Georges Elhedery took a six-month break from HSBC in 2022, some feared he had called time on a 17-year stint at the Asia-focused lender. But two years on, the novice Mandarin-speaker is just weeks away from becoming chief executive.

The Lebanese-born banker, appointed on Wednesday to succeed outgoing boss Noel Quinn from September, has worked in some of the bank's top roles since 2005, mainly across its Middle East and Africa businesses.

He has served as chief financial officer since 2022, in a role that some analysts and investors said he was unsuited to, but which would bolster his leadership credentials.

Quinn said HSBC had succession in mind when Elhedery, better known for his strategic vision and people management skills, replaced former NatWest high-flyer Ewen Stevenson, who had already crafted a vast cost-cutting plan to boost the bank's lacklustre profits.

Elhedery's latest promotion, to arguably the biggest job in European banking, is much less of a surprise to shareholders and insiders, many of whom said the man known for taking 10-km runs before work was the obvious choice.

In a post on professional networking site LinkedIn on Wednesday, Quinn said Elhedery understood HSBC's heritage, its "unique position in the world" and the "importance of putting clients' needs first".

Thomas Moore, senior investment director at Abrdn, one of the bank's 30 largest shareholders said this was a "more politicised appointment than virtually any other bank", given the requirement to get on with clients, regulators and politicians globally.

One of Elhedery's former colleagues, who also served in the bank's top ranks, pointed to Elhedery's "excellent temperament" describing him as low-key but decisive.

HSBC and Elhedery declined to comment.

FROM BEIRUT TO PARIS

Elhedery, 50, was born during Lebanon's civil war that split its capital Beirut into Christian east and Muslim west, growing up with a retail banker father and teacher mother, he has said in past interviews.

He later moved to Paris to study engineering at the École Polytechnique and took a postgraduate degree in statistics and economics.

He began his banking career as a rates trader in the Global Banking and Markets division, where HSBC houses its trading and investment banking advisory businesses, and rose through the ranks.

In 2016, he took over the Middle East, North Africa and Turkey region, managing 10,000 staff across all the bank's business lines and overseeing risk, financial crime, compliance and capital management.

In 2020, some 15 years after joining the Global Banking and Markets business, Elhedery became its co-head, taking over from fellow Lebanese-born, Paris-educated banker Samir Assaf.

A slew of global lockdowns forced by the COVID-19 pandemic followed, and HSBC saw its dealmaking activity disappear overnight, as did other banks.

Business also shrivelled in its bellwether Hong Kong market, the bank's biggest profit engine.

Britain's Prudential Regulation Authority mothballed the bank's dividend in a massive blow to retail and institutional investors, who would later demand that executives haul HSBC out of Britain in an extended war of words.

Just as global activity resumed in early 2022, Elhedery took a sabbatical to spend more time with his family.

He returned to work in September that year, after recharging his batteries and learning Mandarin - quietly underscoring his ultimate ambition to one day land the bank's top job.

Elhedery takes on a bank in good but imperfect shape, investors say.

While Quinn was able to calm the disquiet among some Asia-based shareholders, questions hover over HSBC's future, as tension builds between the West and China, and could increase further after U.S. presidential elections in November.

Central banks are inching towards rate cuts that will trim HSBC's margins, and competition for bumper stock market listings and takeovers is fiercer than ever.

A second shareholder, one of the lender's 20 largest, said Elhedery was a popular choice among UK investors, who were keen to see focus on delivering present goals rather than any major strategic shifts.