Investing.com – Even as Federal Reserve (Fed) chair Janet Yellen cancelled her appearance initially scheduled for Wednesday, Fed governor Jerome Powell will step up to the plate later on Tuesday to make what could be the first official comments on the Brexit, as the U.K.’s decision to leave the European Union (EU) is known, from a member of the U.S. central bank.

Other than a standard statement published on the website that showed that “the Federal Reserve is carefully monitoring developments in global financial markets, in cooperation with other central banks, following the results of the U.K. referendum on membership in the European Union”, no word has arrived on how the surprise voting response may have altered the Fed’s outlook for the normalization of monetary policy.

Yellen had warned prior to the vote that a Brexit could "negatively affect financial conditions and the U.S. economic outlook" and admitted that it was one of headwinds discussed at the June meeting where the monetary authority unanimously opted to hold steady.

The Brexit caused markets to officially take the possibility of a Fed rate hike this year off the table, despite the fact that Fed officials had indicated expectations for two increases in 2016.

Moreover, Fed fund futures now currently put the likelihood of a cut in interest rates as higher than the probability of a hike at the July meeting, with odds at 4.8% and 0%, respectively.

In fact, expectations keep the possibility of a rate cut in the lead until the December 14 decision when a hike shows odds of 16% and easing settles at 13.2%.

Still, markets price in a 70.8% chance that interest rates will stay at the current range of 0.25% to 0.50% through the end of the year.

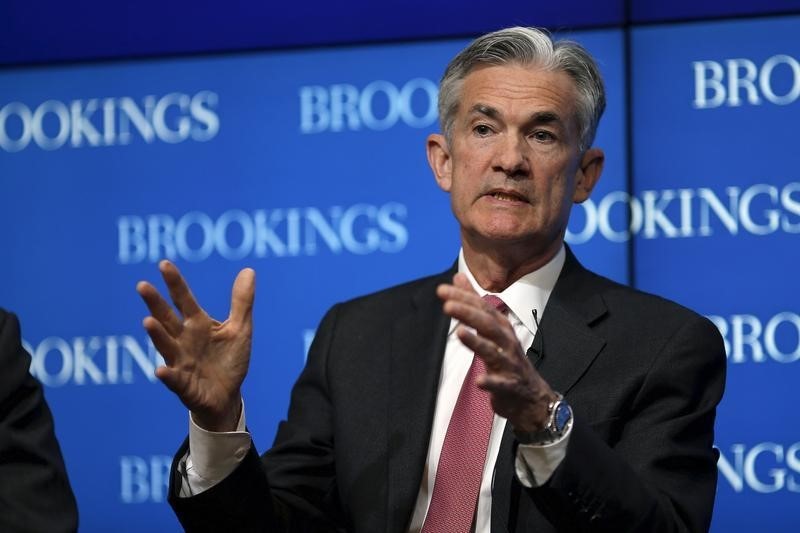

Powell, a known hawk with voting rights on monetary policy decisions, will speak after markets close on Tuesday at 23:00GMT, or 19:00ET.

The speech to be delivered at the Chicago Council on Global Affairs: Food, Fuel and Finance Series is titled “Recent Economic Developments, Monetary Policy Considerations, and Longer-term Prospects” and may give markets a first taste of how and if the Fed’s outlook for policy normalization has shifted in light of the British of referendum.