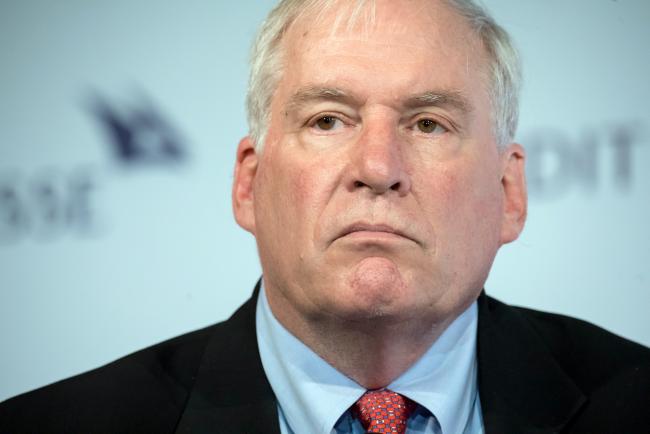

(Bloomberg) -- Federal Reserve Bank of Boston President Eric Rosengren said the uncertainty surrounding the U.S.-China trade dispute adds a downside risk to his forecast for the economy, giving the central bank another reason to be patient as it keeps interest rates steady.

“While my baseline forecast assumes that a trade agreement will occur without seriously disrupting global trade or global economies, it may be some time before that uncertainty is resolved,” Rosengren said in the text of a speech he’s scheduled to deliver Tuesday in New York.

The Paris-based Organization for Economic Cooperation and Development on Tuesday downgraded its projection for global growth in 2019 to 3.2% from 3.3% because of rising trade tensions. Bloomberg Economics also released a report estimating that higher tariffs could lower global economic output in 2021 by 0.6% -- close to $600 billion -- in “an extreme scenario.”

Despite the risk, Rosengren said he still expects the U.S. economy to grow enough in 2019 to put additional downward pressure on unemployment that has already reached a 49-year low at 3.6%.

With low unemployment and inflation sending the Fed conflicting signals over the proper path for rates, he said he’s happy to keep the target range for the Fed’s benchmark interest rate at 2.25% to 2.5%.

Inflation Target (NYSE:TGT)

“I see no clarion call to alter current policy in the near term,” he said. “I view current policy as slightly accommodative and likely to be consistent with inflation returning to the Fed’s 2% inflation target over time.”

Addressing tepid inflation, Rosengren became the latest Fed official to refer reassuringly to a “trimmed-mean” measure of price pressures that excludes the most volatile components. It’s most recent reading was 1.96%, roughly in line with the Fed’s target, compared to the 1.5% measured by the Fed’s preferred gauge, the price index for Personal Consumption Expenditures. He added that recent wage increases should eventually put upward pressure on prices.

“In the absence of continued improvements in productivity, a rising trend in wages could eventually place upward pressure on inflation,” he said.

He added, however, that after years of undershooting their own inflation objective, Fed officials would be “wise to admit to some uncertainty about this part of the forecast.”

That’s part of the reason he supports the Fed’s ongoing review of its strategy for pursuing low and stable inflation and “whether the Federal Reserve should aim for somewhat above-target inflation during recoveries” in order to keep long-run inflation expectations at around 2%.

The Fed will release minutes Wednesday of its April 30-May 1 policy meeting, possibly shedding more light on the variety of views within the Federal Open Market Committee. Rosengren is a voter this year on the policy-setting panel.