By Trevor Hunnicutt

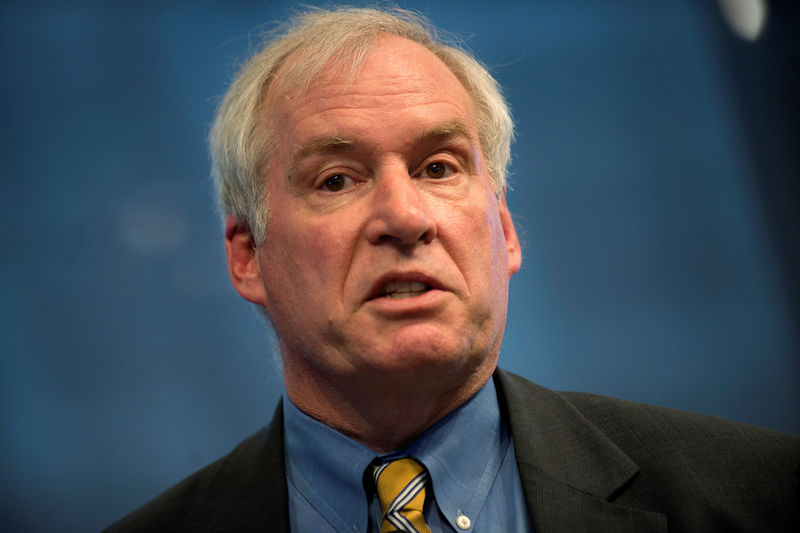

NEW YORK (Reuters) - Boston Federal Reserve President Eric Rosengren on Friday pushed back against expectations for an interest-rate cut when Fed policymakers meet later this month, saying the U.S. economy does not need a boost the way some other countries might.

"It makes sense that if I was in Japan or if I was at the ECB (European Central Bank) that I would seriously be thinking about easing," Rosengren said in an interview with CNBC. "The U.S. economy is not at that point, the economy is actually quite reasonable at this stage. So, if that were to change, I'd be happy to ease that point. But I don't want to ease if the economy is doing perfectly well without that easing."

In a separate interview, conducted Thursday and published Friday, Rosengren told the Wall Street Journal that economic data had improved since the Fed met in June, when it held rates steady.

On Thursday, comments by New York Fed President John Williams (NYSE:WMB) stoked expectations that the U.S. central bank would cut rates by a half-percentage-point when it meets on July 30-31. But those expectations were deflated just hours later when a New York Fed representative said the comments were not meant to signal policy actions at the upcoming meeting.

The Fed is widely expected to cut rates for the first time in a decade at its July meeting. Friday was the last day that investors will hear from Fed officials until they release their policy statement at the close of the July meeting.

In remarks prepared for delivery at an academic conference in New York, Rosengren made the case for keeping the central bank's actions independent from politicians.

"It is important that central banks have flexibility to adjust their tactics to a changing economic environment," he said.

Rosengren did not mention U.S. President Donald Trump, who has continually expressed his displeasure with the central bank, saying that its four rate hikes in 2018 have held back economic growth. On Friday, Trump took to Twitter yet again to reiterate calls for lower rates, slamming the Fed for what he called its "faulty thought process."