By Trevor Hunnicutt

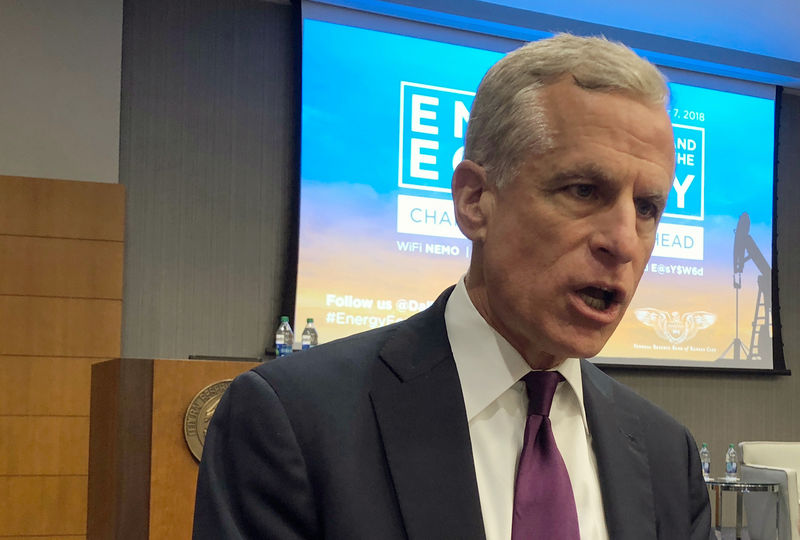

SAN ANTONIO, Texas (Reuters) - The U.S. economy is slowing and it could take a few months to figure out by how much, supporting the Federal Reserve's rate-hike holiday at least through June, Dallas Federal Reserve Bank President Robert Kaplan said on Thursday.

"I don't think we should be taking any action on the fed funds rate," he said.

Kaplan also told reporters at an event in San Antonio that the Fed will come to decisions on what to do about its $4 trillion in bonds and other assets in "the not-too-distant future." However, he declined to say if a decision would come by the Fed's March 19-20 meeting because the deliberations are a group effort.

Fed Chairman Jerome Powell said on Wednesday policymakers will stop shrinking the portfolio later this year, ending a process that investors say works at cross-purposes with the Fed's current pause on interest-rate hikes.

Those plans need to be drafted in a way that will keep bond-buying as a viable tool should it be needed during the next downturn, Kaplan said, nodding to potential political push-back.

"My own attitude is that we need to have that as one of several tools in the event of a downturn," Kaplan said in response to a question from Reuters. "I know there's some political sensitivities to the size of the balance sheet and other issues, but I think it's a critical tool."

The Fed introduced the unorthodox policy effort of buying Treasuries and mortgages in the aftermath of the financial crisis, when rates hit zero and the Fed's typical policy tool lost ammunition.

Asked if the balance sheet has capacity today to respond to the next downturn, Kaplan said "the answer needs to be yes."

In the meantime, the Fed's decision to pause on rate hikes makes sense in light of an economy that is slowing, Kaplan said earlier at a Real Estate Council of San Antonio meeting.

There are examples in the U.S. Treasury market where some shorter-term bonds yield more than long-term bonds, a fact that points to market skepticism about the direction of the economy, he said.

And he told reporters that, even though unemployment rates were poised to tick down further in 2019, businesses are telling him that they may stop hiring as they grapple with slower economic growth.

Kaplan also said he is open to tweaks to Fed policy that would encourage the central bank to let inflation run temporarily a bit over its 2 percent annual target, which it has struggled to meet.

But he said that proposals for how the Fed could implement those changes come with their own challenges, including how to effectively communicate them to the public. Kaplan said he has not made up his mind on the matter.