By Jason Lange

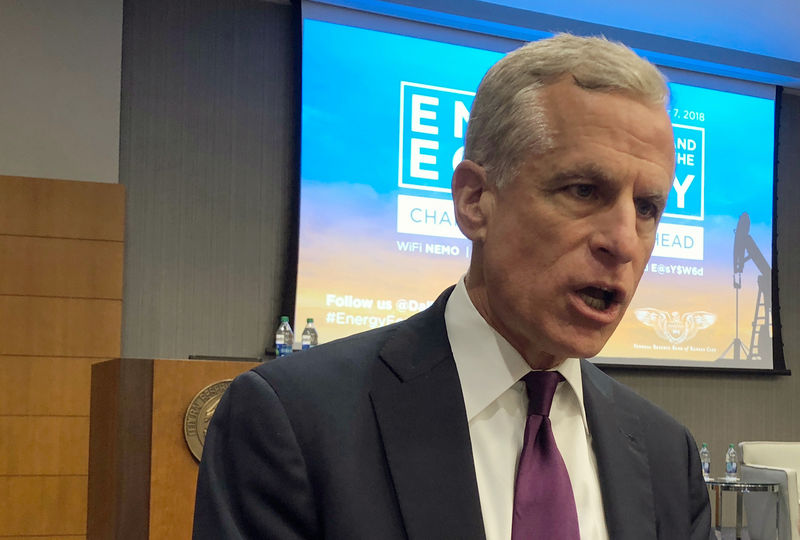

WASHINGTON (Reuters) - Dallas Federal Reserve Bank President Robert Kaplan on Tuesday said the best argument for easing U.S. monetary policy is the narrow gap between short-term and long-term interest rates.

His comments are a sign of the growing momentum for interest rate cuts at the U.S. central bank. As recently as June 28, Kaplan had said he was not ready for rate cuts.

On Tuesday, he said U.S. economic data still points to relatively strong growth despite the impact of international trade tensions, a global slowdown and the waning effects of a U.S. fiscal stimulus enacted last year.

But he is increasingly concerned by persistent signs from the bond market that weaker economic conditions could lie down the road.

"If it was appropriate to take action, the best argument for me of why to do that is the shape of the curve," Kaplan told reporters in Washington, adding that the gap between the Fed's benchmark rate and financial market rates also weighed in his mind.

"That is more tactical than saying I see something in the economic outlook that says we should embark on a strategy change," he said.

The yield on 10-year Treasury securities has been persistently lower than the yield on 3-month Treasury bills since May. Many analysts see this as a sign that investors are betting the economy could weaken, and indeed prices for many financial instruments suggest investors are betting on rate cuts this year.

Kaplan said cutting rates because of a depressed yield curve would not necessarily mean the Fed is on the path for additional cuts.

"I don't want to over read or over react (to) what these markets are saying," Kaplan said.

Kaplan's new view on the argument for cutting rates was reported earlier in the day by the Wall Street Journal.

(This story has been refiled to correct day of the week to Tuesday)