By Jason Lange

MERIDIAN, Miss. (Reuters) - The U.S. Federal Reserve might need to cut interest rates if an escalating trade war with China drags on and leads consumers to cut spending in response to higher prices, a Fed policymaker said on Friday.

Washington on Friday raised tariffs dramatically on about $200 billion worth of Chinese imports.

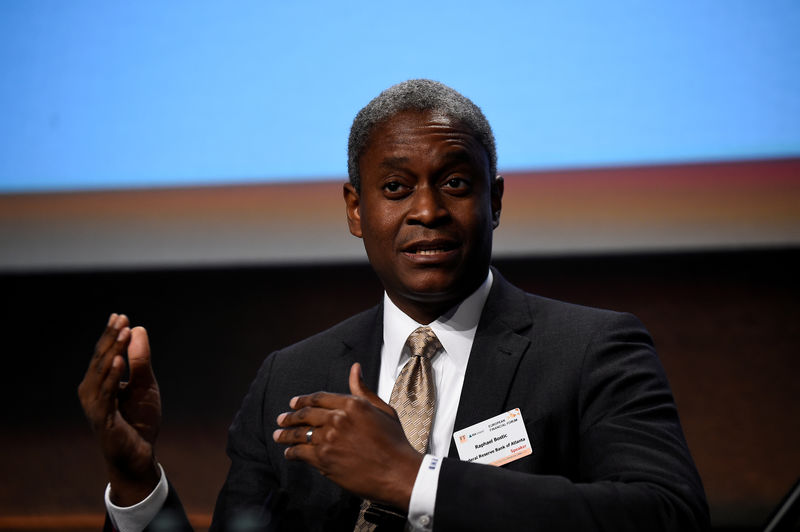

Atlanta Federal Reserve President Raphael Bostic said it will take some time to know how the tariffs will affect the economy and the Fed can be patient about interest rate policy in the meantime.

But he said it was possible the tariffs could lead businesses to raise prices high enough that consumers pull back, which could push policymakers to respond.

"I'm open to doing whatever it takes to keep us on target," Bostic said, referring to the prospect of the trade conflict leading the Fed astray of its targets of full employment and 2 percent inflation.

Asked if this could include interest rate cuts, Bostic said: "Depending on the severity of the response it could."

Bostic said the Fed might not need to alter its plans on interest rates at all if the hike in tariffs is not prolonged.

He said his "base-case scenario" for this year remained a single interest rate increase. But that too is based on his expectation that inflation will show signs of picking up.

"I'm not in any rush to get there," he said.