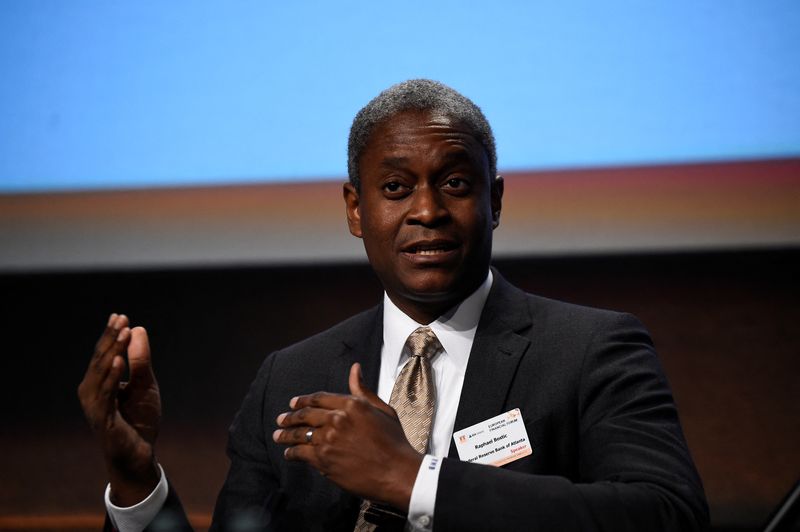

Investing.com -- Atlanta Fed president Raphael Bostic said Tuesday he expects the Fed deliver a rate cut by year end should disinflation continue, but remained wary of cutting rates too soon, calling for a "little more data" to lower the risk of the Fed having to reverse course should inflation unexpectedly pick up pace.

"If economy evolves as I expect, there would be a rate cut by the end of the year," Bostic said, adding that the Fed needs "see a little more data," to ensure that the inflation trend is real.

"It would be really bad if we cut rates and then had to raise them again," the Atlanta Fed president said.

Bostic remarks come on the heels of producer inflation slowing more than expected in July, with focus now on the consumer price index data due Wednesday.

Data released earlier Tuesday showed the producer price index rose 0.1% on a monthly basis in July, compared with the 0.2% rise expected by economists. Annually, it rose to 2.2%, versus an estimate of a 2.3%.

"A cooler-than-expected PPI report offers welcome support for those in favor of a near-term rate reduction," Stifel said in a recent note just a day head of fresh inflation data with the release of the consumer price index.

Bostic downplayed recession fears, and signaled little incentive to rush rate cuts, saying that labor market was "solid" and can slow but "without considerable concern."