By Trevor Hunnicutt

(Reuters) - The Federal Reserve may need "several meetings" to get a good read on the U.S. economy, a top monetary policymaker said on Tuesday, a clear signal that the Fed's rate-hike holiday may last for a while.

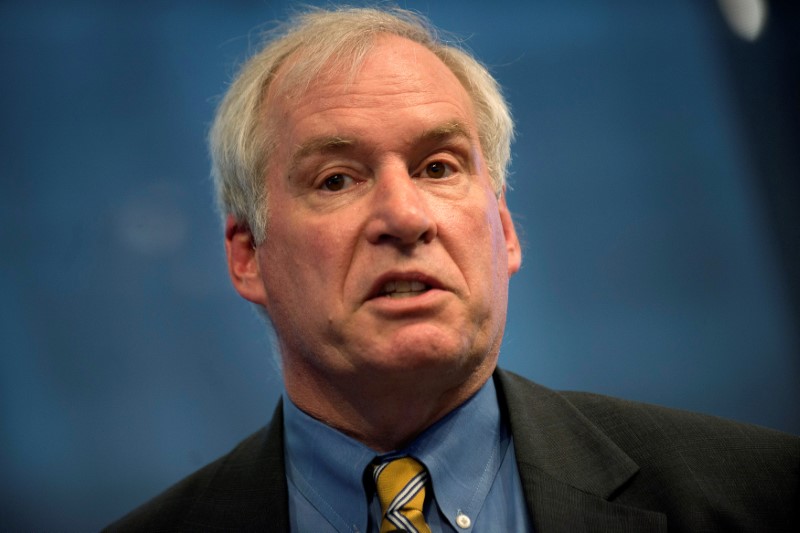

Eric Rosengren, president of the Federal Reserve Bank of Boston, said earlier concerns that the economy might overheat without higher interest rates now seem "less pressing," with little inflation pressure and sharp market swings at the end of 2018 making investors less ebullient.

At the same time, slower growth in Europe and China and ongoing trade conflict make it hard to have confidence about the U.S. economy staying strong, he said.

The remarks in a speech on Tuesday represent a stark change in emphasis for Rosengren, who is a voting member on the Fed's policy-setting Federal Open Market Committee this year. As recently as January, he said two rate hikes could still be necessary in 2019 if optimistic economic forecasts came true.

Fed officials signaled in January that rate hikes were on hold, saying they would be "patient" before making any moves, after raising rates four times in 2018.

"It may be several meetings of the Federal Open Market Committee before Fed policymakers have a clearer read on whether the risks are becoming reality - and by how much the economy will slow compared to last year," Rosengren said in remarks prepared for a chapter of the National Association of Corporate Directors in Boston. "Patiently watching to see how the economy develops is the appropriate policy for now, and represents prudent management of risks to the forecast."

The Fed's next policy meeting will be held March 19-20, followed by gatherings in April, June and July.

Asked if a rate hike would be warranted if the economy develops as he expects, Rosengren was noncommital but said there could be circumstances that would require tightening to be "on the table." He added that the Fed's "patient" stance means not giving "a lot of guidance" as to what the Fed is expecting.

Rosengren, who last year said tight labor markets could spark inflation, on Tuesday said that strong hiring trends are not showing "much risk" of pushing prices higher, possibly because companies have enough profits to eat higher costs.

He forecasts U.S. economic growth "somewhat" above 2 percent in 2019, with inflation close to the Fed's 2 percent target. Yet bonds and foreign stock prices reflect elevated risk, sending an unclear message about what lies ahead.