By Jonathan Spicer

NEW BRITAIN, Conn. (Reuters) - The Federal Reserve is set to hike interest rates more rapidly than investors currently expect, a top Fed official said on Monday, again pushing back on what he said was investors' too pessimistic view of the U.S. economy and monetary policy.

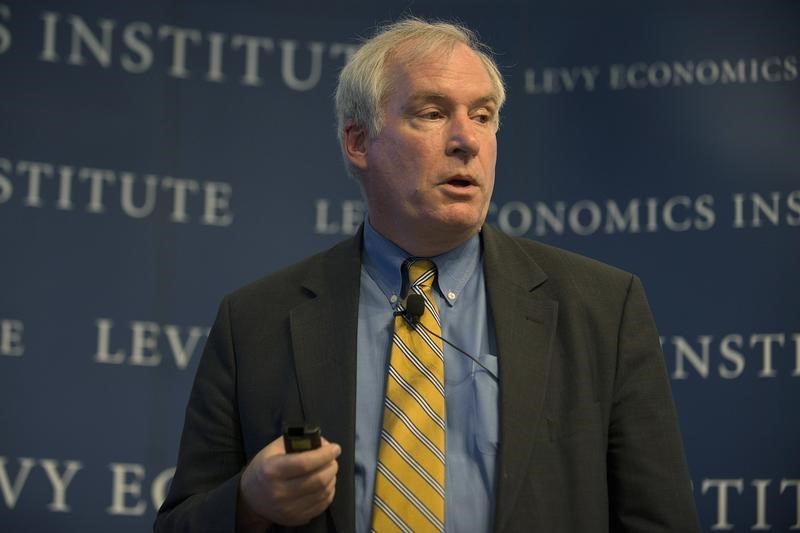

It was the second time in as many weeks that Boston Fed President Eric Rosengren warned that futures markets, which see only one modest rate hike in each of the next few years, are off the mark. He said U.S. inflation was now "much closer" to the Fed's goal, downplayed weak growth in the first quarter, and said the economy is "fundamentally sound."

The comments suggest that even the Fed's dovish wing is uncomfortable with deep skepticism in markets that the central bank will be able pull off its planned tightening cycle, in the face of an overseas slowdown and paltry global demand.

"While I believe that gradual ... rate increases are absolutely appropriate, I do not see that the risks are so elevated, nor the outlook so pessimistic, as to justify the exceptionally shallow interest rate path currently reflected in financial futures markets," said Rosengren, a voter on policy this year and among the Fed's "doves," or those who typically want to keep rates lower.

"I would prefer that the Federal Reserve not risk making the mistake of significantly overshooting the full employment level, resulting in the need to rapidly raise interest rates – with potentially disruptive effects and an increased risk of a recession," he told students at Central Connecticut State University.

The Fed raised rates modestly from near zero in December, its first policy tightening in nearly a decade. While futures markets imply no further hikes until December, economists polled by Reuters see June as the most likely time for a second move. Fed projections imply about two more hikes before year end.

While Rosengren did not say when he expects the Fed to move, his confident speech appeared meant to keep the door open to a June hike.

He said that strong jobs growth and more labor market participation offset what will likely turn out to be less than 1 percent gross domestic product growth in the first quarter. He also noted the Fed's preferred price measure, at 1.7 percent, is headed toward the central bank's 2-percent goal.

"While there have been significant headwinds from abroad, and market turbulence related to those headwinds, I view the U.S. economy as fundamentally sound and likely to perform better than the domestic economies of most trading partners," Rosengren said.

Market predictions for rates have been consistently more cautious than that of the Fed, which has had to backtrack on more hawkish forecasts over the last few years.

Yet Rosengren took one last shot at futures markets, saying that such an extremely gradual path of rate hikes would risk overheating the economy.

He said that while it is "quite appropriate to probe how low" unemployment, now at 5 percent, can go, such "dour interest rate projections do not seem consistent with the outlook for the economy that I and many others share."