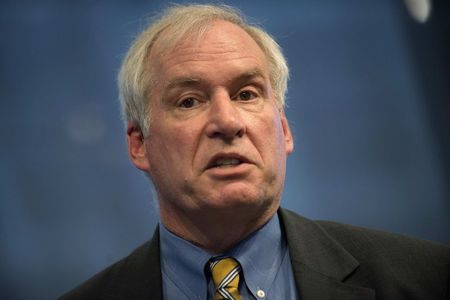

By Howard Schneider LEXINGTON Va (Reuters) - The Fed should fight low inflation as vigorously as it would a too rapid run-up in prices or risk the same sort of prolonged slow growth plaguing Japan and Europe, Boston Federal Reserve bank president Eric Rosengren said on Monday.

Rosengren, in remarks at Washington and Lee University devoted to the potential costs of inflation that remains stuck below the Fed's two percent target, said the Fed's own credibility was at stake. Failure to get inflation to target, he said, raised the risk that investors and consumers would slip into deflationary thinking, changing their spending and investment patterns in ways that would further undermine growth.

"Japan's experience and now Europe's current situation both indicate that indifference to very low inflation rates can generate a significant loss of confidence in the ability of a central bank to hit its inflation goal," Rosengren said, noting that low bond yields globally indicate investors have "little expectation" the Fed and other major central banks will be successful in lifting prices.

He repeated his call for the Fed to remain patient in raising rates until it is more certain that inflation will rise to the Fed's target. As it stands, he said, a collection of global and domestic forces are conspiring against that - from the fall in commodity prices to slow growth among U.S. trading partners and the absence, so far, of broadbased wage increases in the United States.

"The Federal Reserve must respond as vigorously to inflation that is too low as we have, historically, when inflation has been too high," he said.

The Fed last month ended one of its major crisis response programs when it stopped adding to its monthly holdings of Treasury bonds and mortgage-backed securities. But interest rates remain near zero, and the U.S. central bank must now judge when it is proper to begin raising them towards a more normal level.

While that "liftoff" date had been expected towards the middle of next year, the lack of any clear uptick in inflation has become a central concern - enough so that some Fed officials have even discussed the possible need for further rounds of monetary stimulus.

Rosengren ticked off a number of reasons why the inflation target is important, such as lightening the relative debt load for businesses and households, and reducing real wage costs for businesses.

(Reporting By Howard Schneider; Editing by Andrea Ricci)