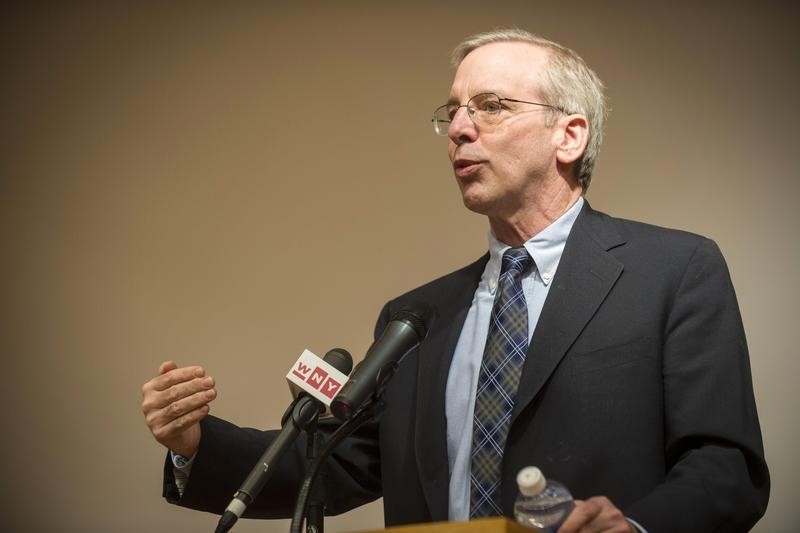

Investing.com – New York Fed president William Dudley commented on Monday that the U.S. labor market had improved and that the central bank would gradually and cautiously normalize interest rates.

“The news for the United States is mostly favorable”, Dudley said in opening remarks at the Transatlantic Economy: Convergence or Divergence Conference.

He noted that labor market conditions had “significantly improved”, the housing sector was recovering and banks were healthier.

Dudley indicated that inflation had fallen short of the 2% target, but said he was confident it will return to the objective in the next few years.

“After years at the effective lower bound for short-term interest rates, economic conditions have finally warranted the start of U.S. monetary policy normalization,” Dudley explained in reference to the Fed’s first rate hike in more than a decade last December.

“But these monetary policy adjustments are likely to be gradual and cautious, as we continue to face significant uncertainties and the headwinds to growth from the financial crisis have not fully abated,” he added.