By Nelson Bocanegra and Rodrigo Campos

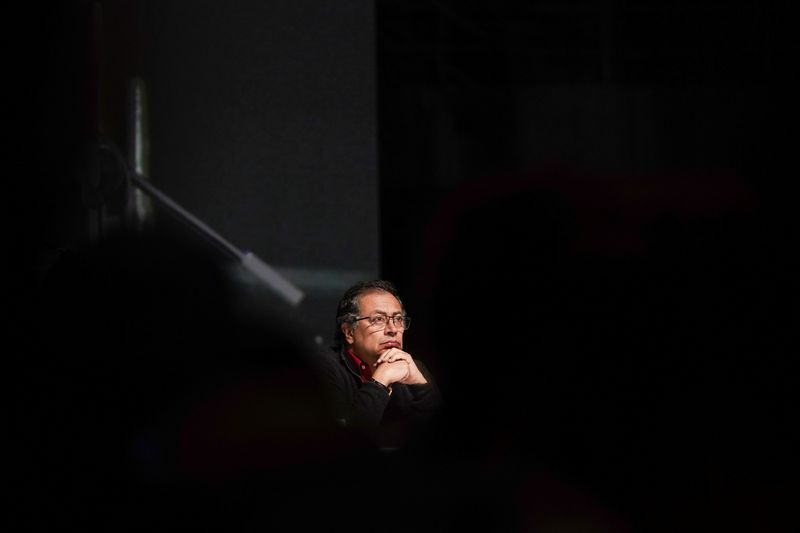

BOGOTA/NEW YORK (Reuters) - Colombia's President Gustavo Petro, the country's first leftist leader in modern times, came to power two years ago under a banner of change and with a mandate to create visibility for the country's poor and underserved residents.

Midway through his presidency, the government's pension reform is the sole major legislation to have been enacted into law, and only after it was diluted by the Congress. Health and labor reforms are stuck and unlikely to pass the legislature in their proposed form.

Even as foreign investment remained strong last year, the Petro administration's push for domestic sovereignty in key economic sectors has created "high levels of uncertainty within the private sector" according to the U.S. State Department - an uncertainty that will hang over the remaining two years of the president's four-year term.

A tight fiscal situation further clouds Colombia's economic outlook. Moody's (NYSE:MCO) changed the oil-producing country's credit outlook in June to negative, citing concerns over government revenue as the economy grows slowly. It remains the only top agency rating Colombia as investment grade.

Here are some indicators of Colombia's economy and markets as well as views on where investors and analysts see the country through 2026:

MARKETS KEEPING WATCH

Financial markets were wary of Petro when he was elected, and similarly to what happened when Mexico and Brazil turned to the left politically, assets depreciated shortly after he took power. The dollar soared to more than 5,000 pesos, a record high, just three months into his term and sovereign debt spreads widened.

"In terms of valuation a bit of panic was created when Petro was elected, but then Colombian assets rallied when the money realized that checks and balances were there," said Carlos de Sousa, an emerging market debt manager at Vontobel. "It was a pretty decent trade for anyone who was there at the beginning."

De Sousa said there is value in quasi-sovereign hard currency debt, in which Vontobel has an overweight position. "Apart from the fiscal policy, there doesn't look like there is much damage being done to the economy."

SPENDING UNCERTAINTY

Petro is Colombia's first left-leaning president in modern times, and his success or failure could determine the future of leftist politics in the country, which has one of the largest economies in Latin America.

The Colombian president had a 50% approval rate after his first 100 days, but he ended his first year in office with his popularity around the current 34% level, according to local pollster Invamer. The centrist politicians who were a part of his cabinet have left, leaving Petro increasingly isolated.

"I think he's frustrated that he hasn't been able to implement more of his social agenda, and so he's trying to find places where he can increase spending within the framework, pushing it really to the limit," said David Austerweil, a portfolio manager at VanEck.

POLITICAL DIRECTION

Analysts argue checks and balances are currently working, as they historically have, to prevent extreme policy decisions from emanating from the presidential palace. Investors will be closely watching Petro's appointments next year of two central bank policy committee members and the election of justices for the highest court, who are nominated by the president and voted on by the Senate, for signs of the government's direction.

"The markets will be very attentive to what happens next year with the appointments to the central bank and to the courts because many investors and analysts believe that the courts are controlling the exaggerated actions of the president, but if judges are appointed who are too close to the government, people will start to be afraid," said Sergio Olarte, head Colombia economist at Scotiabank.

THE ECONOMY

Private investment plummeted 24.8% annually in Colombia in 2023, one of the reasons behind the economy's slowdown to 0.6% output growth, about half of what was expected. Gross domestic product expanded 7.3% in 2022. In the first quarter of 2024, private investment fell 13.4% on a year-on-year basis.

With foreign investment in the country remaining strong last year, some investors have been able to take advantage of "mispricings" that have materialized in sectors of the Colombian economy due to domestic overreaction to Petro's policies.

"That's almost always the case, foreign investors have a little (more) objectivity, but also they're solving ... something different," said VanEck's Austerweil, adding that foreign investors look for outcomes that impact inflation, debt or deficits, which directly translate into variables like spreads and rates and the currency exchange.

"Whereas, if you live in a country, you feel all the social changes so personally, right? How could you not? That makes sense, but it can impact financial market prices in a way that leads to overreactions."

BATTLE AGAINST INEQUALITY

Petro has taken credit for reducing poverty, a key issue for the former guerrilla. Government figures show a reduction in poverty to 33% in 2023 from 36.6% in the prior year. Inequality in Colombia, however, remains persistent despite the improvement - last year the country was deemed the most unequal in the world according to the Gini coefficient, which measures income distribution.

"It is a government that has turned its attention to the lowest level of the population in a very prioritized way," said Sergio Guzman, the director of Colombia Risk Analysis, a consultancy.

"Symbolically this is something that gives the government strength, but practically it is not something that the government can advance on," he said, pointing to scalability issues in some programs.

Guzman noted that Petro is becoming far less interested in reaching consensus on divisive issues and much more proactive in considering radical solutions. "This fight between pragmatism and idealism is one that will generate a lot of noise in the last two years of Petro's government," he said.