By Kevin Yao and Elias Glenn

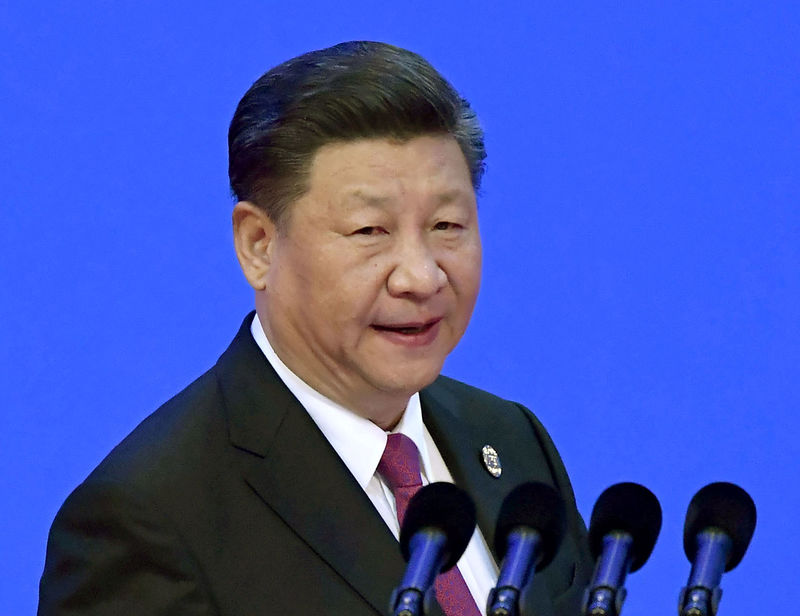

BOAO/BEIJING, China (Reuters) - Chinese President Xi Jinping promised on Tuesday to open the country's economy further and lower import tariffs on products like cars, in a speech seen as an attempt to defuse an escalating trade dispute with the United States.

While much of his pledges were reiterations of previously announced reforms that foreign businesses say are long overdue, Xi's comments sent stock markets and the U.S. dollar higher on hopes of a compromise that could avert a trade war.

Xi said China will widen market access for foreign investors, addressing a chief complaint of its trading partners and a point of contention for U.S. President Donald Trump's administration, which has threatened billions of dollars in tariffs on Chinese goods.

(GRAPHIC: U.S. and Chinese tariffs - https://tmsnrt.rs/2GXE9qr)

Trump struck a conciliatory tone in response to Xi's speech, saying in a post on Twitter that he was "thankful" for the Chinese leader's kind words on tariffs and access for U.S. automakers, as well as his "enlightenment" on the issue of intellectual property.

"We will make great progress together!" Trump tweeted.

Washington charges that Chinese companies steal the trade secrets of American companies and force them into joint ventures to get hold of their technology, an issue that is at the center of Trump's current tariff threats.

The latest comments from both leaders appear to reinforce a view that a full-scale trade war can be averted, although there have been no talks between the world's two economic superpowers since the U.S. tariffs were announced.

"President Xi’s speech appears to have struck a relatively positive tone and opens the door to potential negotiations with the U.S. in our view. The focus now shifts to the possible U.S. response," economists at Nomura said.

"But of course actions speak louder than words. We will keep an eye on the progress of those opening-up measures."

The speech at the Boao Forum for Asia in the southern province of Hainan had been widely anticipated as one of Xi's first major addresses in a year in which the ruling Communist Party marks the 40th anniversary of its landmark economic reforms and opening up under former leader Deng Xiaoping.

Xi said China would raise the foreign ownership limit in the automobile, shipbuilding and aircraft sectors "as soon as possible" and push previously announced measures to open the financial sector.

"This year, we will considerably reduce auto import tariffs, and at the same time reduce import tariffs on some other products," Xi said.

He said "Cold War mentality" and arrogance had become obsolete and would be repudiated. His speech did not specifically mention the United States or its trade policies, which have been assailed by Chinese state media in recent days.

Vice Premier Liu He had already vowed at the World Economic Forum in January that China would roll out fresh market opening moves this year, and that it would lower auto import tariffs in an "orderly way".

Chinese officials have promised since at least 2013 to ease restrictions on foreign joint ventures in the auto industry, which would allow foreign firms to take a majority stake. They currently are limited to a 50 percent stake in joint ventures and cannot establish their own wholly owned factories.

Tesla's Chief Executive Elon Musk has railed against an unequal playing field in China and wants to retain full ownership over a manufacturing facility the company is in talks to build there.

"This is a very important action by China. Avoiding a trade war will benefit all countries," Musk tweeted after Xi's speech.

Foreign business groups welcomed Xi's commitment to reforms, including promises to strengthen legal deterrence on intellectual property violators, but said the speech fell short on specifics.

"Ultimately U.S. industry will be looking for implementation of long-stalled economic reforms, but actions to date have greatly undermined the optimism of the U.S. business community," said Jacob Parker, vice president of China operations at the U.S.-China Business Council.

EASING OF TENSION

Jonas Short, head of the Beijing office at Everbright Sun Hung Kai, said the market was cheered by Xi's speech because it was framed in more positive terms which could ease trade tensions, but he voiced caution about promised reforms.

"China is opening sectors where they already have a distinct advantage, or a stranglehold over the sector," Short said, citing its banking industry, which is dominated by domestic players.

Xi's renewed pledges to open up the auto sector come after Trump on Monday criticized China on Twitter for maintaining 25 percent auto import tariffs compared to the United States' 2.5 percent duties, calling such a relationship with China not free trade but "stupid trade."

Analysts have cautioned that any Chinese concessions on autos, while welcome, would be a relatively easy win for China to offer the United States, as plans for opening that sector had been under way well before Trump took office.

But Vice Commerce Minister Qian Keming said at the forum on Tuesday that China's economic reforms were driven by domestic factors and not due to external pressures.

Xi said China would accelerate opening up its insurance industry, with Shanghai Securities News citing a government researcher after the speech saying foreign investors should be able to hold a controlling stake or even full ownership of an insurance company in the future.

Trump's move last week to threaten China with tariffs on $50 billion in Chinese goods was aimed at forcing Beijing to address what Washington says is deeply entrenched theft of U.S. intellectual property and forced technology transfers from U.S. companies.

Chinese officials deny such charges, and responded within hours of Trump's announcement of tariffs with their own proposed commensurate duties.

The move prompted Trump last week to threaten tariffs on an additional $100 billion in Chinese goods, which have yet to be identified. None of the announced duties have been implemented yet, offering room for negotiation.

Beijing charges that Washington is the aggressor and spurring global protectionism, although China's trading partners have complained for years that it abuses World Trade Organization rules and practices unfair industrial policies that lock foreign companies out of crucial sectors with the intent of creating domestic champions.

While U.S. officials, including Trump, have recently expressed optimism that the two sides would hammer out a trade deal, Chinese officials in recent days have said negotiations would be impossible under "current circumstances".

Dallas Federal Reserve Bank President Robert Kaplan, on a visit to Beijing, said he was optimistic that very few if any of the proposed tariffs by the United States and China announced in recent weeks will actually be implemented.

"I think it’s so clearly in the interest of both countries that we have a constructive trading relationship and that we have substantive talks to redress these issues.”