BEIJING (Reuters) - China has agreed to grant Japan a 200 billion yuan ($31.4 billion) investment quota for the first time to buy Chinese stocks, bonds and other assets, the Xinhua official news agency quoted Chinese Premier Li Keqiang as saying on Wednesday.

The quota will be for investments under the Renminbi Qualified Foreign Institutional Investor (RQFII) programme, which was set up in late 2011 to allow overseas financial institutions to use offshore yuan to buy securities in mainland China, including stocks, bonds and money market investments.

Li was also quoted as saying that China holds a positive attitude towards setting up a yuan clearing bank in Tokyo.

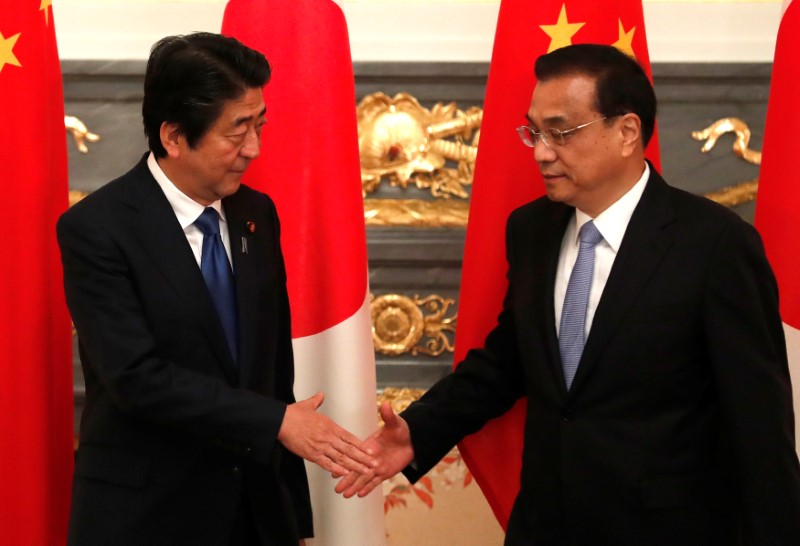

He made the comments at a meeting with Japanese Prime Minister Shinzo Abe, China's state council said on its website.

China will sign a bilateral currency swap agreement with Japan, the Chinese government said on Tuesday, citing an article written by Premier Li that was published by Japan's Asahi newspaper.

In 2016, China granted the United States a 250 billion yuan RQFII quota to help deepen ties between the world's two largest economies.

China resumed a key outbound investment scheme in late April, granting qualified domestic financial institutions fresh quotas to buy overseas stocks and bonds for the first time since early 2015.

($1 = 6.3728 Chinese yuan)