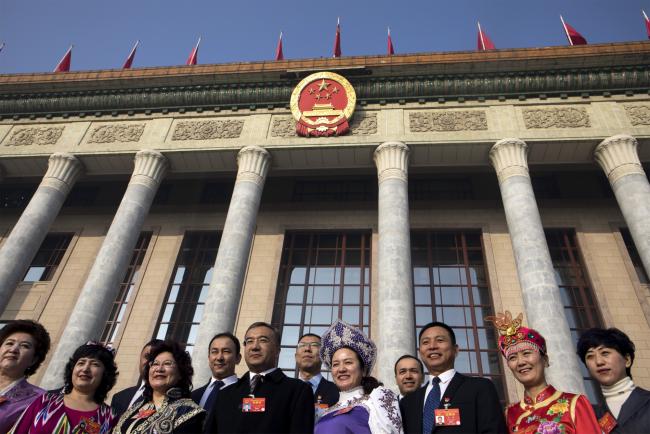

(Bloomberg) -- Ongoing trade tensions with the U.S. and slowing growth have taken a toll on China’s economy. Those issues are dominating the National People’s Congress, an annual gathering of the country’s most powerful officials that continued Wednesday in Beijing.

Here are the latest developments from China’s biggest meeting of the year. (Time-stamps are local time in Beijing.)

Driving Consumption by Increasing Income (10:57 am)

National Development and Reform Commission Vice Chairman Ning Jizhe tells reporters that China looks to bolster consumption with measures like income raising and tax cuts. It also plans a further opening of its agriculture and mining sectors, he says. The country’s annual work report, released Tuesday, announced some $298 billion in tax cuts for the coming year.

China’s Policy Bank’s New Task: Resolving Hidden Debt (10:29 am)

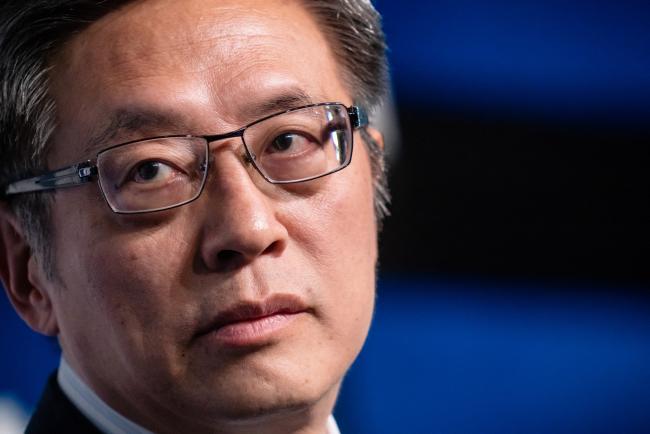

China Development Bank is going to play a new role in resolving hidden and off-balance sheet local government debt -- which has been a focus for top policy makers as the country works to curb financial risks.

China’s largest policy bank is working with the Ministry of Finance on specific cases of hidden local government debt, the bank’s president Zheng Zhijie said. CDB hopes the central government will coordinate a national policy, he added.

Tuesday

CIC Vows to Boost Alternative, Direct Investments (11:43 am)

China Investment Corp. will bolster alternative and direct investments amid an increasingly shaky global economic outlook. In recent years, CIC has expanded into direct investments, looking to smooth out returns and create a hedge against volatile public markets.

The “focus is to increase the share of non-public market, especially alternative and direct, investments,” Tu Guangshao, president of the $941 billion sovereign wealth fund, says on the NPC’s sidelines. “That’s our strategic choice to tackle market uncertainties.”

CIC’s focus for direct investments is to find projects that can match China’s shift toward more high-tech industries and away from low-end manufacturing, and growth in consumer consumption, Tu says.

“No Question” China Will Expand Opening, CBIRC Says (10:56 am)

The country has taken continuous steps forward, says Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission -- for example, allowing overseas insurers to enter the Chinese market.

Trade negotiations between the U.S. and China have made progress in six areas, he says, without specifying. “In the past there have been misunderstandings,” he says. “For example currency manipulation. This is untrue. We are maintaining stable currency.” His comments come as President Donald Trump and Chinese leader Xi Jinping are reportedly close to a deal after months of dispute.

Guo also addresses financial supply side reform, which has been a buzzword for Chinese markets ahead of the NPC. After Xi’s pivot to growth helped send the country’s stocks to a months-long high, investors are eager for details on how the shift will be implemented.

“Part of supply side reform is to make sure funds can get to smaller firms,” says Guo, who’s also Communist Party chief for China’s central bank. China “must create a stronger capital market.”

Local Government Debt Swap Program to Continue (9:50 am)

The program will continue in 2019 in order to ease local governments’ interest burdens, Premier Li Keqiang says in lengthy opening speech at the Great Hall of the People. Beijing encourages addressing local government financing vehicles’ debt problems appropriately with market-based ways, the premier adds.

No Discussions on Plan to Merge State Automakers (9:41 am)

“We haven’t yet discussed any plan” to merge the three auto groups owned by the central government -- FAW, Dongfeng and Changan -- says State-owned Assets Supervision and Administration Commission Chairman Xiao Yaqing on the NPC’s sidelines. A merger will depend on the situation of the overall market, he says.

The three vehicle makers are competitors, but the government encourages them to collaborate, Xiao says.

MIIT Minister Says More Stimulus for Auto Industry (9:26 am)

“There will be more to come,” Minister of Industry and Information Technology Miao Wei says when asked whether China will roll out more stimulus policies to boost its auto industry. The measures will “not necessarily” be fiscal support, he says.

Miao also addresses two other auto issues. He says “it should be the case” that local government subsidies for new energy vehicles will be phased out, and that the funds should be directed to charging infrastructure. He also says the 2019 new energy vehicle subsidy policy will be announced “very soon.”

Shangai-London Connect Is Still Being Studied (9:11 am)

Plans for setting up a system to allows cross-border stock listings between the Chinese financial capital Shanghai and London are still being studied, China Securities Regulator Commission Chairman Yi Huiman tells reporters. When asked if the country’s recent market rally was healthy, he says “we respect the market.”

Xiaomi’s Chair Addresses Trade Deal (9:10 am)

It’s “very” likely that the U.S. and China will reach a deal in the current circumstances, the tech company’s Chairman Lei Jun tells reporters. He also says Xiaomi’s globalization plan is going “very smoothly” and that it will emphasize the European market this year. It may still take time to enter the American market, Lei adds.

Chinese Premier Speaks (9:00 am)

Renhe Group Development Co. Chairman Yang Wenlong said a major vat tax cut announced in Li’s annual work report to the NPC would reduce the company’s annual tax burden by at least 200 million yuan ($30 million). He also said Renhe has benefited from policies boosting private firms and that pharma stocks have further potential.

Chinese policymakers look to pull off a gradual deceleration as they battle a debt legacy and the U.S. trade standoff. They also lowered China’s official goal for economic growth Tuesday morning, setting the 2019 target released to the NPC at a range of 6 percent to 6.5 percent.

“The Chinese government has been working on scaling back taxation as well as fee charges. If in place the VAT cut would be a great boost to the auto industry,” says SASAC’s Xiao.