SHANGHAI (Reuters) - A senior Chinese securities regulator vowed to maintain financial stability and prevent asset price bubbles as the country accelerates the opening-up of its financial markets to foreign investors.

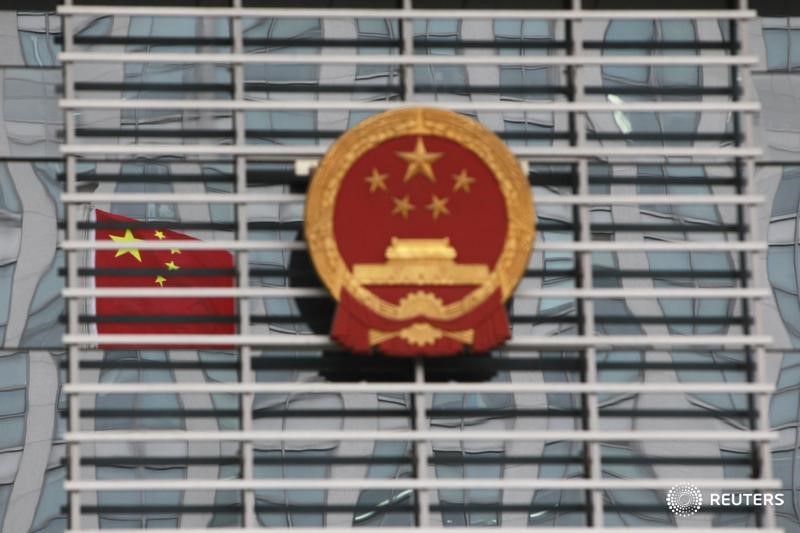

The comments by Fang Xinghai, vice chairman of the China Securities Regulatory Commission (CSRC), came days ahead of Chinese shares being included in MSCI's global benchmark indexes, which some analysts expect could trigger tens of billions of money inflows in the early stages.

They also follow a raft of market opening measures by China in recent months, including the launch of crude oil futures trading, and the opening of its iron ore futures market to foreign investors.

"Currently, global institutional investors are generally underweight Chinese assets. With China's rising economic clout, and the growing importance of the Renminbi, increasing foreign inflows will be the norm," Fang told a financial forum in Shanghai.

"Under such circumstances, it's important to maintain stability of the financial markets ... and ensure there are no price bubbles in various financial assets including stocks, bonds, loans, and derivatives."

Fang said financial deregulation in other developing countries has offered China a wealth of lessons.

"If financial markets are healthy, short-term fluctuations in cross-border capital flows would not turn into a lasting tide, so that disturbance to the (domestic) financial system is temporary and limited. Otherwise, a small, unexpected incident could potentially destroy an edifice built on sand."

Underscoring regulators' commitment to further opening, Fang said a planned stock link between Shanghai and London is on track.

CSRC is "working hard" on the Shanghai-London Stock Connect, and aims to roll out the first product under the scheme by the end of this year, he said.

Meanwhile, overseas-listed Chinese tech firms will soon issue China depositary receipts (CDRs) on Shanghai and Shenzhen bourses, Fang said.

Commenting on the MSCI entry, which will see 234 China-listed big cap stocks included in MSCI's emerging markets benchmark on June 1, Fang said "China's stock market will embrace the most forceful and sustainable participation from global institutional investors."

As China promotes cross-border financial investments, CSRC is also stepping up cooperation with regulators in other markets to reduce financial risks.

For example, CSRC and Hong Kong's securities regulator has signed a memorandum of understanding on the supervision of cross-border derivative products, in expectation of an increase in such instruments, Fang said.

A transcript of Fang's speech was posted on the CSRC website.