Investing.com - China's growth target of 6.5% or better in 2016 relies on a production-based economic model as policymakers at the same time attempt a shift to more consumer-led growth.

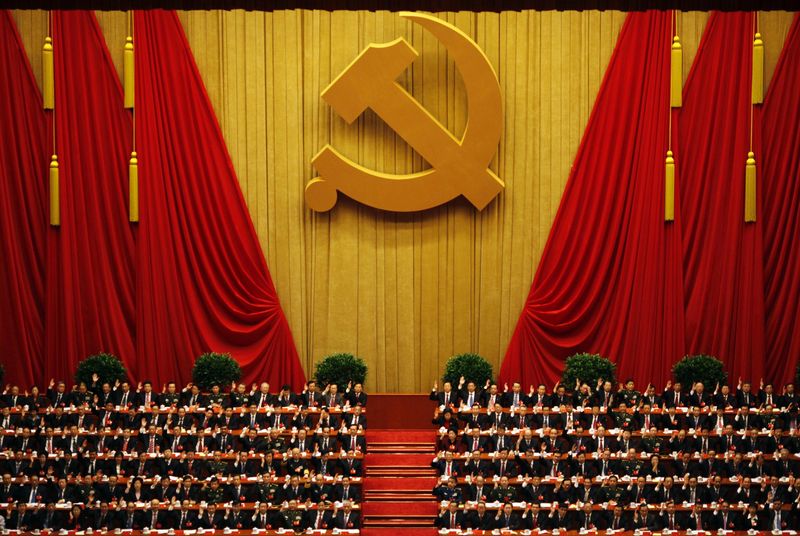

That is the contrast at the hear of the world's second largest economy with Premier Li Keqiang telling delegates at the National People's Congress on Saturday that the government is aiming for expansion of gross domestic product this year of 6.5% to 7% in real terms and of at least 6.5% a year in the next five years.

Many analysts doubt the target can be met.

"Given the subdued prospects for organic growth drivers such as exports and private investment, 6.5% is an ambitious growth target that will require significant macroeconomic policy stimulus," said Louis Kuijs, chief Asia economist at Oxford Economics who previously worked at the World Bank.

"Insisting on meeting growth targets set five years ago in different circumstances is likely to detract from the more painful reforms and reduce the appetite for reining in credit growth and reducing excess capacity. This is a pity because growth of around 6% is also sufficient."

China's economy grew 6.9% in real terms last year on the back of monetary easing and limited fiscal stimulus.

Those policies, Li's report said, should continue, but the effects may lack the same punch as seen in the past, especially with ratings agencies such as Moody's this month changing the outlook on China's government credit ratings to negative from stable.