By Carolina Mandl

NEW YORK (Reuters) - Hedge fund Bridgewater Associates said the Federal Reserve independence is probably a top issue in the U.S. presidential election, according to a commentary sent to clients on Tuesday and reviewed by Reuters.

The comments by one of the world's biggest hedge funds, which had around $100 billion in assets under management in August, adds to worries voiced by other investors about the Fed independence. Fed's independence is crucial for investors as any political influence on monetary policy could disrupt key bets on the path of inflation and economic growth, in the U.S. and globally.

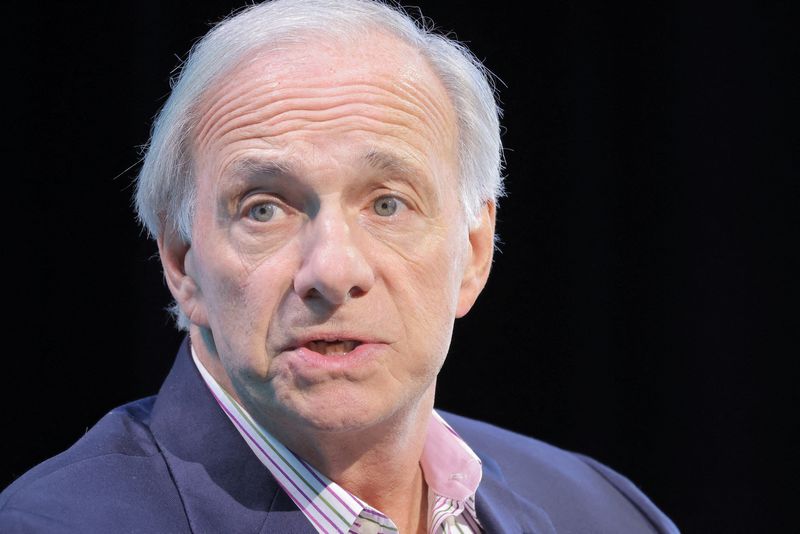

Founded by legendary investor Ray Dalio, Bridgewater actively bets on the direction of various types of securities — including stocks, bonds, commodities and currencies — by predicting macroeconomic trends.

"Probably maybe most structurally important, is Fed independence and what this will do to the nimbleness of policy makers in the U.S.," co-chief investment officer Greg Jensen said when mentioning potential policy changes following the race.

Republican nominee Donald Trump has occasionally signaled interest in influencing the Fed's policy, saying the U.S. president should have a say over interest rate decisions. Last week, Trump appeared to back away from previous comments as he said he believes he would have a right as president to tell the Fed what to do about interest rates but he would not order a move.

"Trump has spoken a lot about his view that he'd be a better central banker than the central banks. The pressure on the institutions in the U.S. is growing for both sides, and particularly Trump being very clear that he doesn't think the Fed should have as much independence from an executive as smart as him," Jensen said.

Trump's campaign did not immediately respond to a Reuters request for comment about Bridgewater's communication to investors.

In sharp contrast, Democratic nominee Kamala Harris has pledged not to meddle with the central bank if she wins the Nov. 5 presidential election.

When talking about his investment hypothesis, Jensen said he is not trying to take a position on the election given how tight the race is between Trump and Harris, and how uncertain a potential Republican or Democratic sweep is.

"Post-election, we think there are important big opportunities for us," Jensen said.

Harris held a marginal 46% to 43% lead over Trump, a Reuters/Ipsos poll showed on Monday. It differed little from her 45% to 42% advantage over Trump in a poll conducted a week earlier. Prediction markets, however, show Trump's odds are higher.

Jensen said both options are "very live" at this point and would implicate "radically different policies," including potential a Republican or a Democratic sweep.

Among other relevant different policies each candidate would implement, Jensen also mentioned areas such as immigration, tariffs, geopolitical tensions and regulation.

The two biggest risks for the U.S. economy now, he said, are the presidential elections and the pricing of financial assets, such as bonds and equities, adding "there’s very little room for error."

Some hedge funds are being more vocal about their forecasts.

Billionaire hedge fund investor Daniel Loeb said he recently adjusted Third Point's portfolio to capture a potential boom in corporate activity after the U.S. election where he expects Trump is more likely to win.

JPMorgan also said in a note last week that global hedge funds have shown "a strong preference" for stocks that could perform well if Trump wins the election.