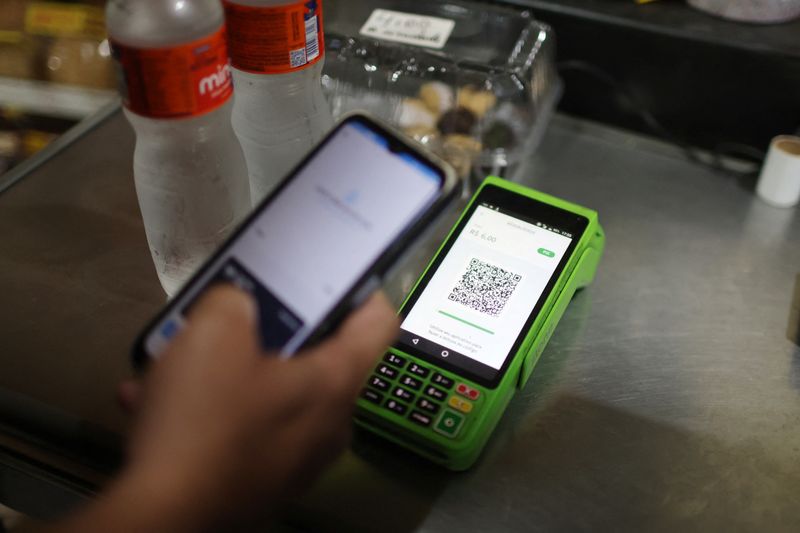

SAO PAULO (Reuters) - Brazil's instant payment system Pix is seen surpassing credit cards as the leader in the local online purchase market as soon as next year, earlier than initially expected, a new study from Brazilian payments firm Ebanx showed on Monday.

Pix was launched by Brazil's central bank at the end of 2020, quickly becoming one of the most used tools for money transfers or purchases as it offers mostly free and instantly-settled transactions.

The study, which is based on data from research and intelligence firm PCMI, showed Pix is expected to account for 44% of Brazil's online payment market by the end of 2025, while credit cards were seen with a 41% slice.

A previous version of the study released earlier this year had projected Pix to nearly match credit cards in the local online market only by the end of 2026.

Ebanx director of country growth for Latin America Juliana Etcheverry told Reuters that Pix has led a financial inclusion approach that encouraged more merchants to offer the instant payment method.

"It's a chicken-and-egg scenario, a virtuous cycle," she told Reuters.

According to the central bank, by late 2022 some 71.5 million Brazilians had been included in the financial system through Pix.

Its growth between retail and travel sectors in the digital market also explains the greater outlook for Pix, Etcheverry said.

Brazil's central bank is expected to launch new Pix features in the next years, including the option to pay through installments, that could make it more of a threat to credit cards.

According to Etcheverry, some former credit card users are already switching to Pix.

The outlook for credit cards did not change much from the previous study, with both predicting a decline from the 49% share of the e-commerce market they had in 2023.

Still, Etcheverry does not believe Pix will end up killing cards. "The cards industry is also investing in protocols, in features that would also make them keep growing in the market."

Central bank said on Monday Pix had recorded 227.4 million transactions last Friday, the most ever for the system in a single day.