By Kaori Kaneko

TOKYO (Reuters) - The Bank of Japan is expected to hold its negative interest rates and 10-year government bond yield target steady next week as a weaker yen and positive overseas conditions augur well for Japan's economic prospects, a Reuters poll showed on Friday.

The yen has weakened significantly versus the dollar since November and Donald Trump's election to president, which has seen the dollar and U.S. markets hit landmark highs.

The dollar is drawing strength from Trump's big spending plans and their expected inflationary effects, as well the Federal Reserve's hints at three more interest rate hikes next year, following Wednesday's 25 basis point increase.

The correspondingly weak yen also helped boost Japanese share prices to a one year-high this week.

The BOJ is expected to maintain the minus 0.1 percent interest rate it imposes on some excess reserves and to hold the 10-year government bond yield target at around zero, the poll of 15 analysts showed.

The BOJ is also expected to keep the pace of the annual increase in JGB holdings at around 80 trillion yen ($676.93 billion), it showed.

"There is no change that the BOJ's 2 percent inflation target is a long way to reach. But a need for more stimulus by the BOJ has declined further because of the weaker yen and higher share prices," said Tuyoshi Ueno, senior economist at NLI Research Institute.

"The focus for next week will be how the BOJ will change its view on the economy, how it assesses recent rises in long-term yields, and how far it can accept rises in these yields," he said.

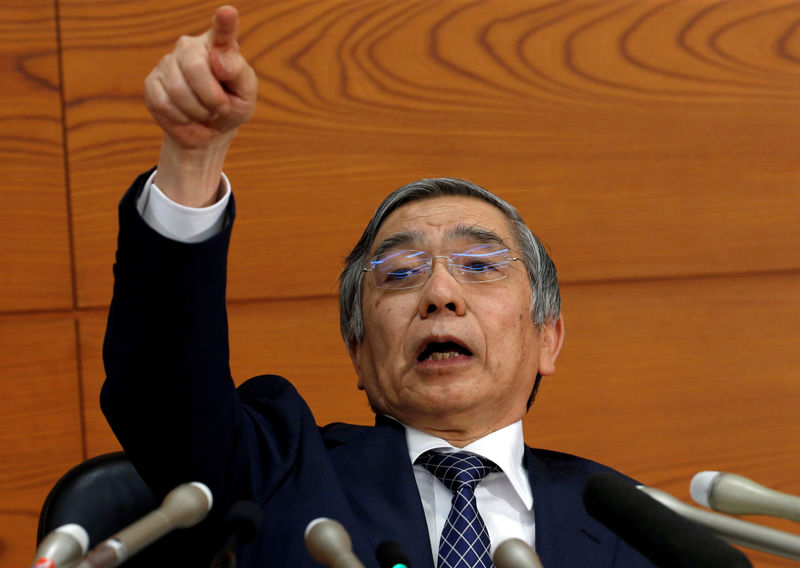

Ueno also added BOJ Governor Haruhiko Kuroda may once again send the message that wage increases are badly needed to meet the BOJ's inflation target, as he did recently.

The benchmark 10-year JGB yield rose to 0.100 percent

Under a new policy framework announced in September, the BOJ pledged to guide short-term rates to minus 0.1 percent and the 10-year JGB yield to around zero percent.

Interest rate hikes are back on the radar at the BOJ, for the first time in a decade, as the U.S. Federal Reserve's tightening cycle pushes global bond yields higher, heralding a new era for central banks retreating from post-crisis stimulus.

($1 = 118.1800 yen)