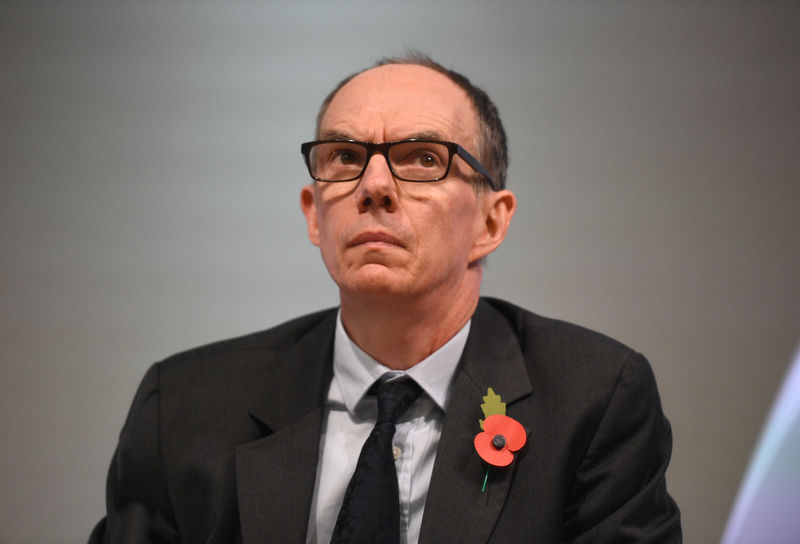

LONDON (Reuters) - Growth is likely to be slower than the Bank of England's Monetary Policy Committee forecast earlier this month as productivity lags and investment risks being weaker than forecast, Deputy Governor Dave Ramsden said on Thursday.

"Relative to the best collective judgment expressed in the MPC's central forecast I am ... a little more pessimistic on GDP growth than my colleagues on the MPC," he told businesses during a visit to Inverness in northeast Scotland.

Ramsden said his outlook for inflation and the right level of interest rates was similar to that of his colleagues, as weak productivity growth was likely to push upward on inflation, cancelling out the drag on inflation from slower GDP growth.

At the start of this month, BoE Governor Mark Carney said investors were underestimating how much interest rates could rise, even as the British central bank kept borrowing costs on hold due to Brexit uncertainty.

Ramsden said a no-deal Brexit with no transition period beforehand would have "large negative economic effects".

But that would not automatically mean interest rates should be cut, due to the inflationary impact of a weaker pound and reduced productivity, he added, sticking to the BoE's current stance on the issue.