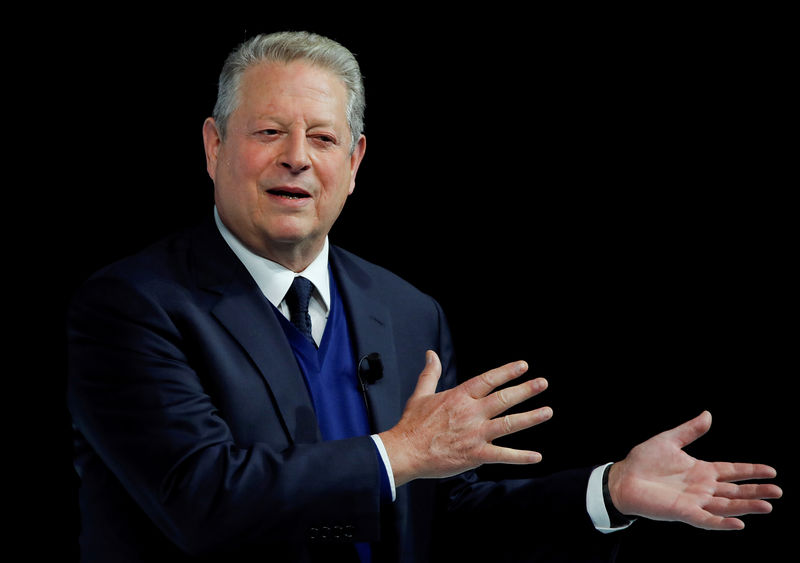

LONDON (Reuters) - Sustainable investment specialist Generation Investment Management, co-founded by former U.S. Vice President Al Gore, has raised $1 billion for its latest private equity fund, it said on Tuesday.

The third and largest of its similar funds, Generation IM Sustainable Solutions Fund III will look to invest between $50 million and $150 million each in companies helping the health of the planet or individuals, or those driving financial inclusion.

“We believe that we are at the early stages of a technology-led sustainability revolution, which has the scale of the industrial revolution, and the pace of the digital revolution," Gore said in a statement.

Demand to invest in a sustainable manner is growing, particularly in Europe, even if the definition of what this means can vary - something regulators in Europe are looking to address.

For Generation, target companies would provide "goods and services consistent with a low-carbon, prosperous, equitable, healthy and safe society".

Of the money raised, $93 million came from wealth management clients of Swiss investment bank UBS , which said in a separate statement its clients were increasingly looking to invest more money into such funds.

Established in 2004 and headquartered in London, Generation IM manages around $22 billion in assets and is focused on sustainable investments across both public and private markets.