By Michael Flaherty

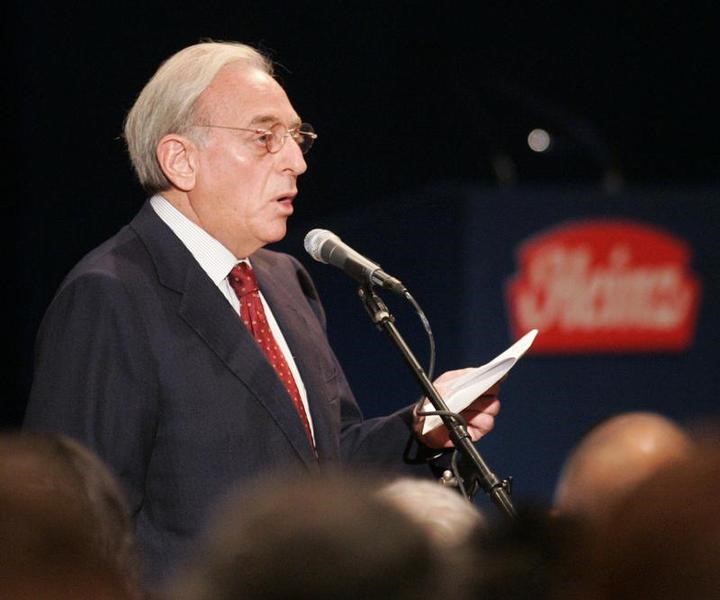

(Reuters) - Trian Fund Management LP, the activist hedge fund run by billionaire investor Nelson Peltz, is ending quarterly redemptions by its new investors, according to people familiar with the matter, in order to lock in money for longer periods.

The change comes as activist hedge funds increasingly seek more stable sources of funding that allow them to keep the pressure on companies, without fretting about the short-term demands of the funds' investors.

Trian is closing its quarterly subscription for investors after Dec.1, the people said. Investors who come in after that date will instead have the option to lock up their money in one of Trian's existing one-, three- or five-year vehicles, the people added.

Trian began to discuss limiting its quarterly subscribers earlier this year, and may decide to reinstate the option in the future to select investors, one of the sources added. The source added that quarterly subscribers who signed up on or before Dec. 1 can still redeem on a quarterly basis.

The sources asked not to be identified because the matter is not public. Trian declined to comment.

Trian is one of several activist funds moving to longer-duration investment capital, which can also allow the funds to go beyond their standard playbook of pushing for stock buybacks and divestitures, focusing instead on improving the business operations of their targets.

"You are definitely seeing more of a private equity mentality here, and activists realize if they are going to run a successful, long-term operation they have no choice but to lock in longer-term capital," said Tyson McCabe, a senior director for Nasdaq's Advisory Services division, which tracks investments by activists.

ValueAct Capital said in its third-quarter letter earlier this month that it would launch a new offering for investors that would lock up their money for five years. The five-year tranche would also allow ValueAct to draw down capital over a period of three years rather than receive it up front.

"In line with that of a typical private equity fund structure, we believe this structure provides additional flexibility to our capital base by having 'dry powder' to draw upon a market pull back and/or around a company specific event," ValueAct said in the letter.

Activist investor Jana Partners started offering a three-year lockup vehicle in 2010. Pershing Square (N:SQ) and European activist Cevian Capital also offer long-term lock-up vehicles for investors. The longer the lock-up period, the lower the fees for investors.

The longer-term offerings show how activists are developing a preference for the types of illiquid investment funds seen more in the private equity industry. Hedge funds have traditionally allowed investors, which include pensions, university endowments and large financial institutions, to cash out every quarter.

Private equity firms, by contrast, typically ask investors to commit to allocate a sum of money that will be locked up for as many as 10 years. Rather than asking for the money up front, the firm calls on the investor to supply chunks of the commitment when needed - any unused money remaining in a fund when it matures goes back to the investors.

Activist funds are also adopting this draw-down feature.

Even so, not all activists will be able to convince investors to commit to long-term arrangements, as they will depend on their performance record. Investors, aware that activists are suffering from lower returns and stiffer headwinds, may be wary of being locked in for longer.