WASHINGTON (Reuters) - New orders for U.S.-manufactured goods dropped more than expected in January, pulled down by a sharp decline in bookings for commercial aircraft, but demand for computers and electronic products accelerated.

Factory orders fell 3.6% after slipping 0.3% in December, the Commerce Department's Census Bureau said on Tuesday. Economists polled by Reuters had forecast orders declining 2.9%. They decreased 1.6% year-on-year in January.

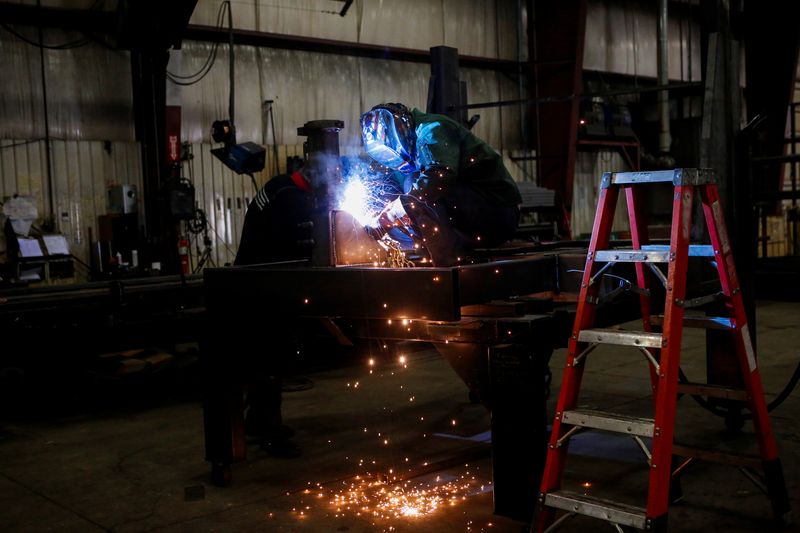

But there are signs that manufacturing, which accounts for 10.3% of the U.S. economy, is on the cusp of recovery after production eased in 2023 amid 525 basis points worth of interest rate hikes from the U.S. central bank since March 2022. A survey from the Institute for Supply Management last week showed manufacturers more upbeat about the outlook.

Commercial aircraft orders plunged 58.9% in January after rising 1.0% in December. Boeing (NYSE:BA) reported on its website that it had received only three orders for commercial aircraft in January, sharply down from 371 in December.

The planemaker is under pressure after a cabin panel blew out on an Alaska Airlines jet mid-air in early January. The Federal Aviation Administration has barred Boeing from expanding production of its best-selling 737 MAX narrowbody planes to improve quality control.

Orders for motor vehicle bodies, parts and trailers rose 0.7%. Overall transportation orders tumbled 16.2% after falling 0.6% in December. But orders for computers and electronic products shot up 1.3%. Electrical equipment, appliances, and components orders increased 0.9%.

Orders for machinery slipped 0.3%. There were also declines in orders for primary metals and fabricated metal products.

Shipments of manufactured goods fell 1.0%, while inventories dipped 0.1%. Unfilled orders at factories rose 0.2% after advancing 1.3% in the prior month.

The government also reported that orders for non-defense capital goods excluding aircraft, which are seen as a measure of business spending plans on equipment, were unchanged in January instead of gaining 0.1% as estimated last month.

Shipments of these so-called core capital goods increased 0.9% instead of 0.8% as previously reported.

Nondefense capital goods orders plummeted 19.5% instead of 19.4% as initially estimated. Shipments of these goods dropped 3.0% as reported last week. These shipments go into the calculation of the business spending on equipment component in the gross domestic product report. Business spending on equipment has contracted for two straight months.