Investing.com’s stocks of the week

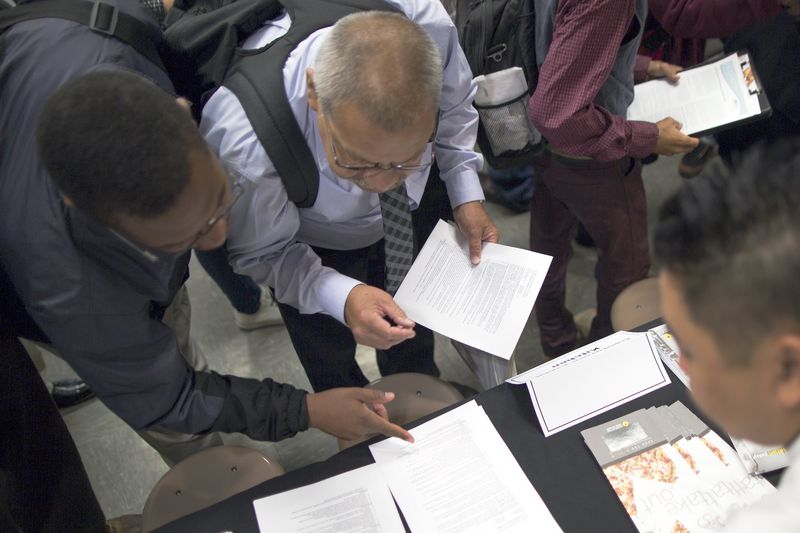

Investing.com - The U.S. economy added the fewest private sector jobs since October 2017 last month, fueling concerns that the labor market is running out of steam.

U.S. private employers added just 129,000 jobs in March, down from 197,000 in February, according to a report by payrolls processor ADP (NASDAQ:ADP) released on Wednesday. Economists had expected a gain of 184,000 jobs.

"March posted the slowest employment increase in 18 months," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute.

Mark Zandi, chief economist of Moody's Analytics which contributes to the report, said employment gains were slowing significantly across most industries and company sizes.

“Businesses are hiring cautiously as the economy is struggling with fading fiscal stimulus, the trade uncertainty, and the lagged impact of Fed tightening,” he said. “If employment growth weakens much further, unemployment will begin to rise.”

The ADP figures come ahead of the Labor Department's more comprehensive non-farm payrolls report on Friday, which includes both public and private-sector employment.

February’s government employment report was also a negative surprise, showing the creation of just 20,000 jobs.

Economists had forecast that Friday’s government report will show the creation of 180,000 nonfarm payrolls, while the jobless rate is expected to hold steady at 3.8%. Most of the focus will likely be on average hourly earnings, which are expected to rise 3.4% from a year earlier, similar to the increase reported in February.

Allianz (DE:ALVG) chief economic adviser Mohammed El-Erian said that a confirmation of the weak ADP reading would indicate two things: “Unusually large monthly job creation is harder to maintain late-cycle; and the handoff to higher wages and labor participation is key.”

Joseph Brusuelas, chief economist at consulting firm RSM US LLP, said he was “sticking with” his previous forecast of 155,000 jobs in total employment for March.

Even though Brusuelas’ own forecast was lower than consensus, he warned that “slowing economic activity during the first quarter places downside risk on our top-line employment growth forecast.”