By Joseph Nasr and Jan Schwartz

BERLIN/HAMBURG (Reuters) - All sectors of the German economy grew in the second quarter, data showed, with robust domestic activity helping to cushion against risks to exports from an uncertain global trade outlook.

Construction and state spending expanded the most, both up 0.6 percent quarter on quarter - but the head of one economic institute said a record public sector surplus meant government investments should be rising more rapidly.

Finance Minister Olaf Scholz cautiously agreed, saying the surplus created "further possibilities" though the precise extent of them would not become apparent until the end of the year.

His remarks could cheer critics who have until now been disappointed in their hopes that the Social Democrat would follow a looser fiscal course than his conservative predecessor Wolfgang Schaeuble, a reluctant spender who was dead set against new debt.

Friday's Federal Statistics Office figures, which matched a preliminary overall growth reading of 0.5 percent, confirmed the increasing reliance of Europe's largest economy on domestic drivers.

"It's a good development (offering) further possibilities," Scholz said in Hamburg after meeting finance ministers from fellow German-speaking countries Austria, Luxembourg and Liechtenstein. He added that he would see at the end of the year exactly how much extra wiggle room had been created.

Private consumption extended its growth run to six straight quarters, reflecting steady falls in unemployment during what has been a long phase of economic recovery.

That surge has fueled criticism of Berlin by its euro zone partners for not helping their economies by spending more of its budget surplus on investments.

Carsten Brzeski of ING Diba said Friday's data should help counter that view. "Defying the often-heard international criticism, the economy is already showing a very balanced growth model," he wrote in a note to clients. It had delivered "a full strike", with all sectors growing.

But after the data also showed the overall public sector surplus soared to a record high of 48.1 billion euros ($55.0 billion) in the first half of the year, the president of the DIW economics institute added his voice to the calls for more investments.

"The massive surplus and tax revenues for the government are a source of envy," Marcel Fratzscher wrote on Twitter. "A smart investment offensive in infrastructure, education and innovation is necessary."

BLUE SKIES FOR NOW

Other critics say that, given the less robust export sector, the government should also approve tax relief for families beyond the 10 billion euros a year it granted in June.

"The state needs to give taxpayers something back. The middle class needs to have more money in its pockets," Bavarian state Premier Markus Soeder told the RND newspaper group.

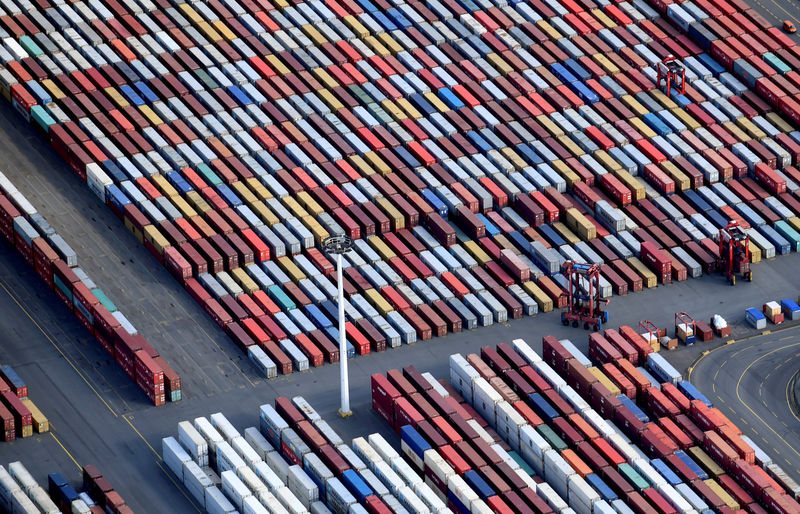

Germany's economy has traditionally been dominated by exports. That sector's prominence has declined in recent quarters, and trade disputes between the United States and many of its largest commercial partners, including the European Union, risk diminishing its influence further.

Stefan Kipar of BayernLB said he saw no signs of that yet, however. "It's encouraging to see that investments did not decline. And we don't see an export weakness," he wrote in a note to clients.

Imports rose 1.7 percent in the second quarter while exports gained 0.7 percent, resulting in net trade deducting 0.4 percentage points from growth.

U.S. President Donald Trump, who has imposed tariffs on steel and aluminum imports from the EU, agreed last month to defer imposing levies on cars imported from the bloc while the two sides negotiate over other trade issues.

A larger-scale trade dispute between the United States and China could also harm Germany, many of whose manufacturers rely on growth in the world's two largest economies.