By Joseph Nasr and Rene Wagner

BERLIN (Reuters) - German industrial output and exports fell sharply in April, highlighting the continued vulnerability of Europe's largest economy to trade frictions and Brexit uncertainty, a day after the European Central Bank signaled concerns about euro zone growth.

Friday's figures from the Statistics Office suggested German GDP growth would slow or even stall in the current quarter, and the Bundesbank slashed its growth forecast for all of 2019, which as recently as December stood at 1.6%, to just 0.6%.

Industrial output dropped 1.9% on the month, the sharpest decline since August 2015, after a steep fall in the production of investment and intermediate goods. Economists had forecast a 0.4% fall.

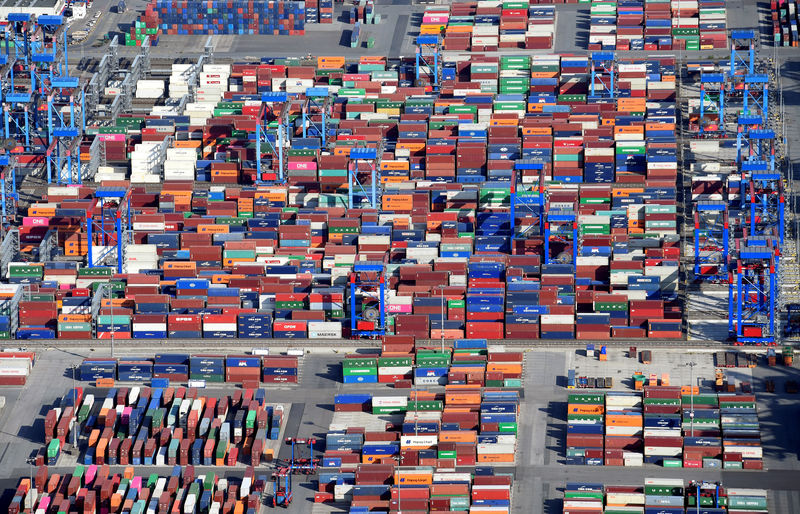

Exports fell 3.7 percent, also the biggest drop since August 2015.

The German economy had only narrowly avoided recession in the last three months of 2018, stagnating after a contraction in the third quarter, and grew a moderate 0.4% in January-March.

"The weak underlying cyclical trend is likely to continue in the second and third quarters of 2019," the Bundesbank said in a statement. "After a slight decrease in the second quarter, real GDP is likely to pick up again somewhat in the third quarter."

German manufacturing has been in recession for much of this year as unresolved trade disputes between the United States and both China and the European Union as well as the effect of Britain's delayed departure from the European Union hit exports.

The ECB on Thursday ruled out raising interest rates in the next year and even opened the door to cutting them or buying more bonds, citing the damaging effect of trade conflicts and Brexit on the euro zone.

'ECB DOVISHNESS JUSTIFIED'

Euro zone weakness is also feeding back to Germany, while pressures on the crucial German automotive sector are now spreading to the chemicals industry.

The services sector, which is more dependent on the local economy, has kept humming, helped by the impetus of a solid labor market and low interest rates for private spending.

But the slowdown in manufacturing is starting to hurt the labor market, with unemployment in May up for the first time in nearly two years, and there are concerns that this could now weigh on services.

"There is no doubt that the German economy had a disappointing start to the second quarter, justifying the European Central Bank's new dovishness," Carsten Brzeski of ING wrote in a note to clients. "It now needs even stronger domestic demand and a bounceback in May and June to avoid a return to recessionary territory."

Andrew Kenningham of Capital Economics told clients: "The fall in industrial production in April adds to the evidence that Germany has not shaken off the problems which hit it nearly a year ago, and suggests that the economy slowed sharply in the second quarter of the year ...

"German industry is still struggling with both domestic and external headwinds, including the weakness of global trade, slowdown in household consumption growth and regulatory confusion in the auto sector," he added. "We don't expect a sustained improvement anytime soon."