By Francesco Guarascio

BRUSSELS (Reuters) - Euro zone economic sentiment jumped as confidence among manufacturers rose while unemployment was at its lowest level in more than a decade, data showed on Thursday, but the mood may quickly turn sour as fears over the coronavirus epidemic mount.

A European Commission's monthly survey said economic sentiment in the 19 countries sharing the euro rose to 102.8 points in January from 101.3 in December, well above the average forecast of 101.8 points in a Reuters poll of economists.

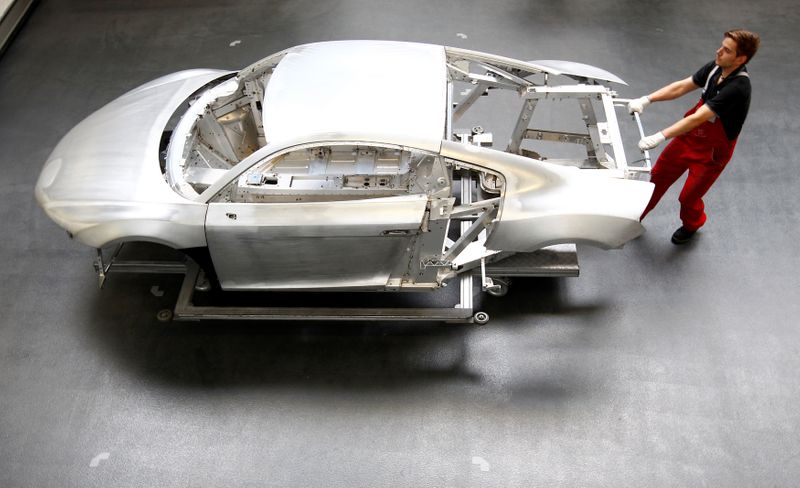

The improvement was driven by higher confidence in industry, as factory managers were more upbeat on their production expectations and their stocks of finished products.

The sector was hit hard last year by global trade wars and seems to have benefited from an initial trade deal between the United States and China signed in mid-January.

But economists warned that the recovery in optimism may be short-lived as experts assess the fallout of the outbreak of the new coronavirus which emerged in China last month.

The positive readings on sentiment and unemployment "are signs that the bottom in manufacturing is now getting close", said Bert Colijn, a senior economist at ING bank.

"One has to be cautious in interpreting these numbers though, as uncertainty around the impact of the coronavirus on the global economy is mounting," he said, adding that was not yet factored into these results released on Thursday.

Among euro zone's largest economies, the industry indicator rose most in Germany, the bloc's top exporter of manufactured goods and the region's biggest economy.

But the overall industry mood remained below the long-term average both in Germany and in the euro zone. The indicator for the services sector, the largest in the euro zone, dropped slightly after three consecutive monthly rises.

The more positive business mood could be a signal of a stronger economy in the first quarter of 2020, as the euro zone leaves behind a year of weak growth.

Unemployment data supported the upbeat view, as the jobless rate dropped in the euro zone to 7.4% in December, its lowest level since May 2008, when the global financial crisis began to hit the bloc, data from the EU statistics agency Eurostat showed.

But economists remained cautious.

"Today's data do not change our view that euro zone economic growth will remain subdued, at least during the first half of this year, and that any subsequent recovery will be weaker than many anticipate," said Melanie Debono, economist at research firm Capital Economics.

She said she expected the euro zone economy to grow around 0.7% this year, well below EU Commission's forecasts of a 1.2% expansion, and less than 1.1% estimated for last year.