LONDON (Reuters) - Euro zone business activity has expanded at its fastest pace in a year this month, supported by buoyant demand for services, while the manufacturing sector showed signs of approaching a recovery, a preliminary survey showed on Thursday.

HCOB's preliminary composite Purchasing Managers' Index (PMI), compiled by S&P Global, climbed to 52.3 this month from April's 51.7, beating expectations in a Reuters poll for a more modest lift to 52.0.

May marked its third month above the 50 level separating growth from contraction.

"This looks as good as it could be. The composite PMI for May indicates growth for three months straight and that the euro zone's economy is gathering further strength," said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank.

Overall prices charged rose at their slowest pace since November and the output prices index dropped to 52.5 from 53.7, potentially opening the door to policy easing from the European Central Bank.

ECB policymakers are widely expected to reduce interest rates when it meets early next month.

An index covering the 20-country currency union's dominant services industry held steady at April's 11-month high of 53.3, shy of the poll forecast for 53.5.

Demand increased with the sector's new business index rising to 53.6 from 52.8, its highest reading in just over a year.

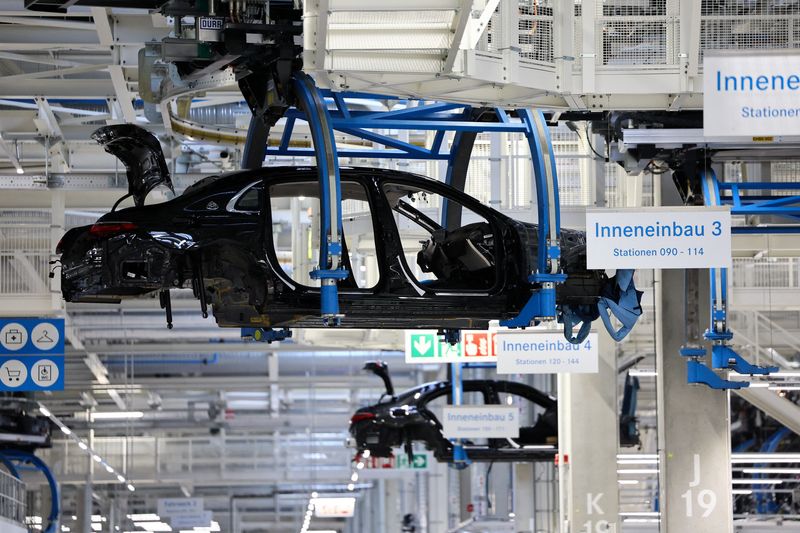

The manufacturing PMI jumped to a 15-month high of 47.4 from 45.7, well ahead of the Reuters poll forecast for 46.2. A subindex measuring output showed only a slight contraction there, jumping to 49.6 from 47.3.

Suggesting manufacturers expect conditions to improve, the future output index rose to 60.1 from 59.1, its highest reading since February 2022.