BRUSSELS (Reuters) - Euro zone economic sentiment edged lower for an eight consecutive month in August, pulled down by less optimism in industry and services, a monthly survey by the European Commission showed on Thursday.

The Commission survey showed the economic sentiment indictor for the 19 countries sharing the euro currency eased to 111.6 points in August from 112.1 in July, continuing a downward trend started since a peak of 115.2 last December.

Separately, the Commission's business climate indictor, which helps identify the phase of the business cycle, fell to 1.22 in August from 1.30 in July, following a similar downward path from a peak of 1.63 in January.

The easing of sentiment in August came with a decline of the indicator for industry, to 5.5 from 5.8, although production expectations rebounded after a July decline.

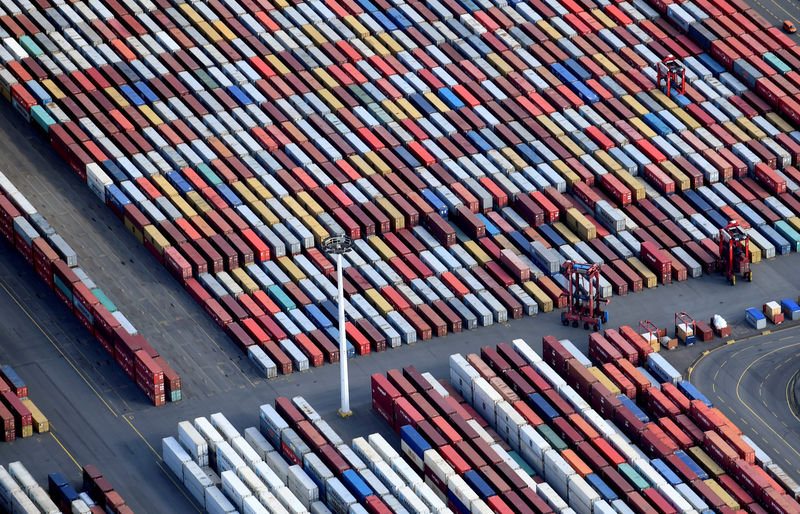

Their views on current overall order books and stocks of finished products worsened, as did the their assessment of export order books.

The survey last month suggested trade tensions between the European Union and the United States, that resulted in the U.S. imposing tariffs on European steel and aluminum exports in June as well as the threat of more tariffs on EU cars, had an effect.

However, the two parties have since agreed to push for closer trade ties. U.S. tariffs remain on EU steel and aluminum, although the threat for the same on EU cars has eased.

Sentiment in services, which generate more than two thirds of euro zone gross domestic product, dipped to 14.7 from 15.3 in July, with worsening demand expectations.

Consumer sentiment also fell, to -1.9 from -0.5 in July.

The mood among retailers and constructors, by contrast, improved.

Consumer inflation expectations over the next 12 months rose to 18.2, close to the long-term average of 18.6. Selling price expectations in industry increased to 10.3 from 9.6 in July.

For European Commission data click on:

https://ec.europa.eu/info/business-economy-euro/indicators-statistics/economic-databases/business-and-consumer-surveys_en