By Jonathan Cable

LONDON (Reuters) - Euro zone business activity picked up a bit last month, extending a period of solid growth, but a growing global trade war kept optimism in check and suggests the pace may not be maintained, a survey showed.

Signs of robust growth and inflationary pressures means the European Central Bank is unlikely to be swayed from closing its 2.6 trillion euro asset purchase program by year-end.

IHS Markit's Euro Zone Composite Final Purchasing Managers' Index (PMI), seen as a good guide to economic health, nudged up in August to 54.5 from July's 54.3, just above an earlier flash estimate of 54.4. Anything above 50 indicates growth.

August's surveys point to quarterly euro zone economic growth of 0.4 percent, matching a forecast in a Reuters poll last month, IHS Markit said. But it also questioned whether the pace could be maintained next quarter.

"The composite PMIs were pretty encouraging," said Jack Allen at Capital Economics.

"The trade war has had some effect. The policies that have been implemented so far by the U.S. hitting the euro zone are pretty small, but worries about protectionism escalating in the future could have had an impact on businesses."

An index measuring optimism sank to a near two-year low of 61.6 from 63.1. Purchasing managers were spooked about the impact of trade wars, IHS Markit said.

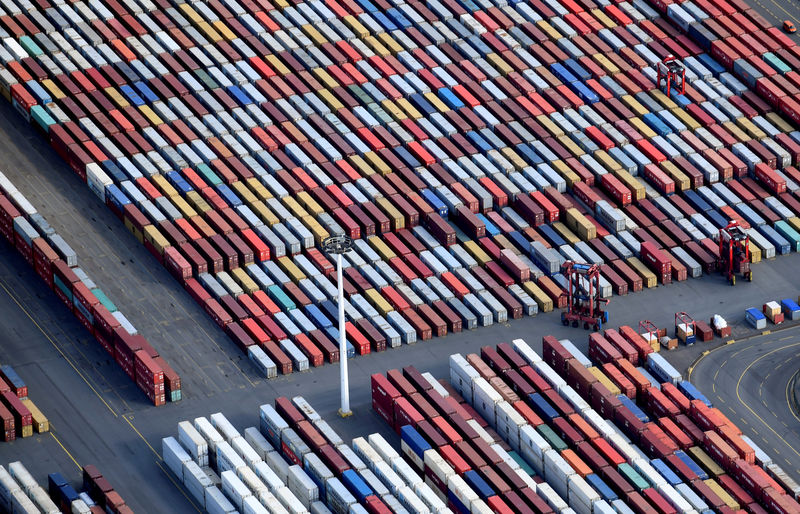

U.S. President Donald Trump has said he is ready to implement new tariffs on Chinese imports as soon as Thursday, which would be a major escalation after Washington earlier applied tariffs on $50 billion of exports from China.

Markets were little moved after the PMI surveys, instead focusing attention on the looming deadline which kept the dollar near two-week highs on Wednesday, inflicting fresh losses on emerging markets and sending world stocks lower for the fourth day in a row.

DOMESTIC HELP

With the trade war intensifying, German services growth was supported by a domestically-driven upswing in Europe's largest economy, reaching a six-month high, and French activity also picked up, earlier surveys showed.

In Britain, outside the currency bloc and set to leave the European Union next year, its large services sector picked up more strongly than expected last month, bucking a slowdown for manufacturers and construction firms.

But Brexit worries are dampening investment plans and confidence for the year ahead.

Britain's economy has slowed since the June 2016 Brexit vote, its growth rate slipping from top spot among the Group of Seven group of rich nations to jostling with long-term laggards Japan and Italy for bottom place in the growth rankings.

Italy's services sector slowed for a second month running in August, according to an earlier PMI.

"The Italian indices were a bit more interesting and a bit more worrying. The big picture is that Italy seems likely to remain a laggard in the euro zone, leaving it vulnerable to further economic shocks and possible sell-offs in the market," Allen said.

Most recent data in the euro zone's third-largest economy have pointed to a slowdown, posing a challenge for the anti-establishment government of the 5-Star Movement and the right-wing League, which took office in June.

A PMI covering the euro zone's dominant service industry rose to 54.4 from 54.2, in line with a preliminary reading but well shy of readings witnessed around the start of the year.

Still, forward-looking indicators were also more positive last month, with new business and backlogs of work accelerating. An index measuring employment -- which is a lagging indicator -- rose to 55.3 from 54.6, its highest since October 2007.

However, euro zone retail sales grew at a more moderate rate than expected year-on-year in July, mirroring a steady weakening of consumer sentiment since the start of the year.