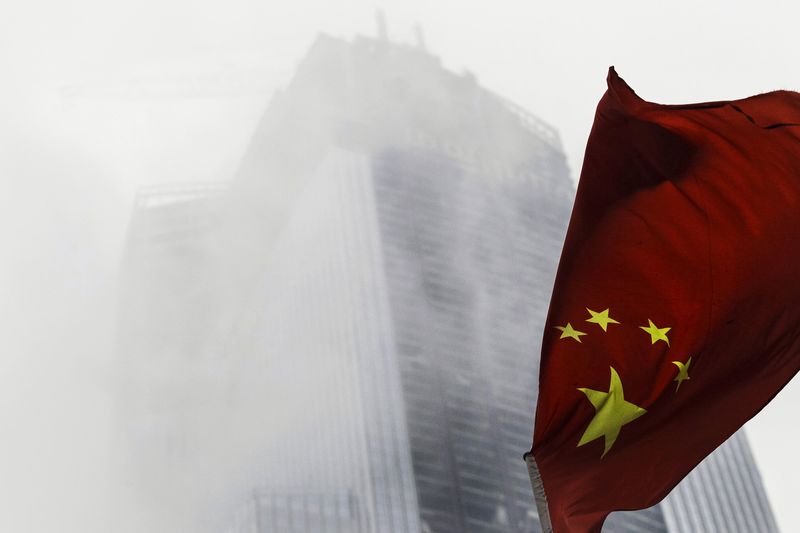

(Bloomberg) -- China’s official manufacturing gauge fell the most in five years in February as the Spring Festival holiday curbed output and export orders fell.

- The manufacturing purchasing managers index dropped to 50.3 from 51.3 the prior month, missing the 51.1 estimate in Bloomberg’s survey

- The non-manufacturing PMI slipped to 54.4 from 55.3 the prior month, the National Bureau of Statistics said Wednesday

- The composite index covering services and manufacturing fell to 52.9 from 54.6 in January. Readings over 50 indicate improving conditions

Top officials are gathering this week to reshape the government, including top economic roles, and repeal presidential term limits to allow Xi Jinping to rule indefinitely. Policy makers also have been intensifying overhauls to address pollution and debt and are likely to unveil new economic objectives next week at an annual legislative meeting.

"It’s always very hard at the beginning of the year to make sense of how things are moving, so I wouldn’t read too much into a seemingly weak number," Louis Kuijs, chief Asia economist at Oxford Economics, said Wednesday in a Bloomberg Television interview from Hong Kong. "We also had quite weak credit data in January and I think together this is indicating that we’re not seeing an acceleration, we’re seeing a softening of growth."

China’s week-long Lunar New Year holiday often distorts data for January and February as the accompanying factory shutdowns and office closures fall at different times each year. This year’s national holiday was from Feb. 15-21, later than last year’s start in January.

|

What our economists say: The data signal "moderation in growth momentum and ebbing reflationary pressure in the factory sector," Bloomberg economists Tom Orlik and Fielding Chen wrote in a report. "The drop in the price pressure that has buoyed industrial profits and made the deleveraging challenge more manageable is particularly striking. That said, disentangling the trend from the holiday effect around China’s New Year break in mid-February is hard to do." |

History shows that the February readings are within the normal fluctuation for the Spring Festival months, the statistics bureau said in a statement with the data. It said business expectations have held up and manufacturing activity is likely to resume its normal pace.

"The holiday effect is definitely a key reason" for the slowdown in manufacturing, said Iris Pang, an economist at ING Groep (AS:INGA) NV in Hong Kong. "Combining the first two months’ data, it’s still a solid start to the year. Looking ahead, I think the overcapacity cuts will still be a major theme this year, only that the focus might be shifted to sectors such as cement and glass from steel and coal in 2017."

Other gauges showed:

- Manufacturing output dropped to 50.7 from 53.5

- Factory employment declined a fourth month, to 48.1

- The 44.8 reading for small businesses was the weakest in two years

- Steel industry PMI fell to 49.5 from 50.9 as output and new orders both deteriorated

- New export orders fell to 49, declining for a second month

"This is the second month we see a decline in new export orders," said Raymond Yeung, an economist at Australia & New Zealand Banking Group Ltd. in Hong Kong. "This highlights the risk of a cyclical downturn in the global electronic supply chain and has a direct bearing on the regional trade outlook."