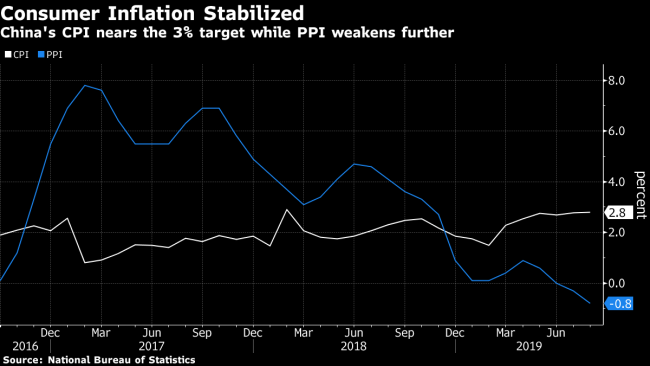

(Bloomberg) -- China’s producer price index fell further into contraction, signaling a worsening economic slowdown that threatens to add deflationary pressures to the global economy.

- Factory prices fell 0.8% in August from a year earlier, compared with a decline of 0.9% in the median estimate of economists in a Bloomberg survey

- The consumer price index rose 2.8% year-on-year, faster than the median estimate of 2.7%

- The contraction in factory prices hurts manufacturers’ pricing power and exports disinflation to the rest of the global economy via exports. The central bank announced fresh easing measures last week including cuts to the amount of cash banks’ hold as reserves, but economists said more stimulus is needed to boost demand

- A manufacturing downturn in China will add to concerns over a global recession

- “With lackluster overall demand and a rising base, PPI may drift further into negative territory,” China International Capital Corp. economists led by Eva Yi wrote in a note

To contact the editors responsible for this story: Jeffrey Black at jblack25@bloomberg.net, Enda Curran

©2019 Bloomberg L.P.