By Kirstin Ridley

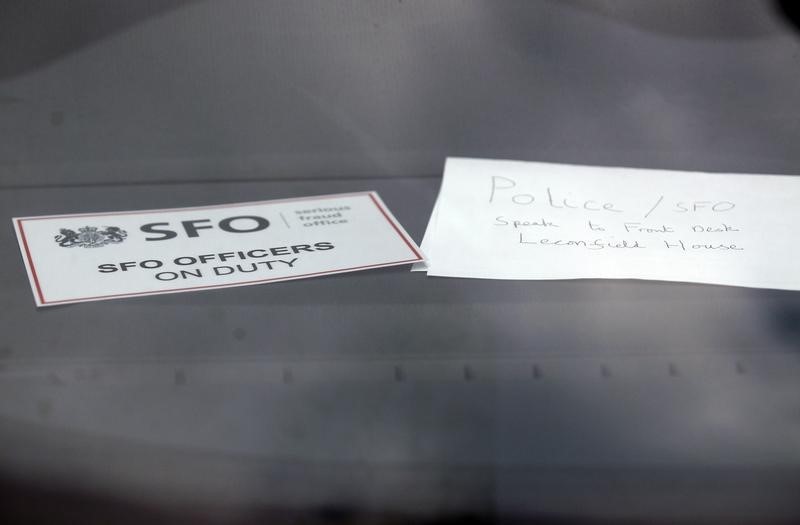

LONDON (Reuters) - Britain's Serious Fraud Office (SFO) has withdrawn European Arrest Warrants against three German traders and one Frenchman after closing an eight-year investigation into allegations that bankers manipulated global Euribor interest rates.

The SFO updated its website on Thursday to confirm that it had ended its case against Joerg Vogt, Ardalan Gharagozlou, Kai-Uwe Kappauf and Stephane Esper. Lawyers for Gharagozlou and Kappauf declined to comment. Esper and Vogt's legal representatives were not immediately available for comment.

The decision brings to a close a string of high-profile prosecutions after an investigation into allegations that bankers rigged two key interest rate benchmarks, Libor (London interbank offered rate) and its Brussels-based Euribor equivalent.

The Euribor investigation proved the trickiest for the SFO. The agency originally wanted to charge 11 individuals, but only seven faced trial. London juries acquitted three and convicted four, but one absconded.

The SFO was granted European Arrest Warrants for four men in 2016 after they declined to attend a London court to be formally charged. Germany and France refused to extradite the men.

The decision draws a line under a saga that began with the prosecution of former UBS (S:UBSG) and Citigroup (N:C) star trader Tom Hayes, who was sentenced to 14 years in 2015 over Libor rigging before his sentence was cut to 11 years on appeal.

Hayes, who is due to be released next January after serving half his term, continues to fight his conviction.

Euribor and Libor rates were designed to reflect the cost of borrowing between banks. But regulators announced plans to scrap Libor after some of the world's top banks reached settlements with authorities over allegations of rate manipulation.

Aziz Rahman, a partner at law firm Rahman Ravelli, said the case had reached its "natural ending."