By Luana Maria Benedito

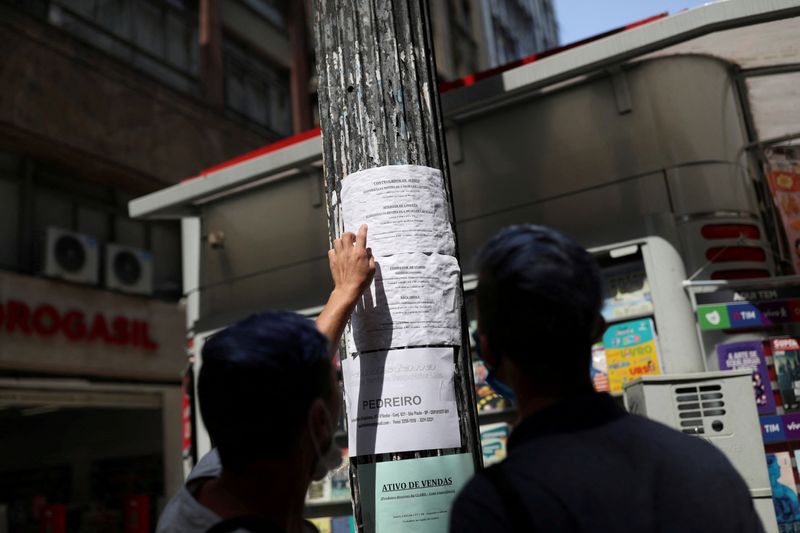

SAO PAULO (Reuters) -Brazil's labor market is posting blockbuster numbers ahead of a central bank rate decision next week, amid bets that the country's rate-setting committee will need to speed up monetary tightening due to inflationary risks.

Brazil's jobless rate fell to 6.4% in the three months through September, statistics agency IBGE said on Thursday, below market expectations and marking the second-lowest unemployment level on record.

The jobless rate was down from 6.9% in the April through June period and from 7.7% a year earlier, according to IBGE. Economists polled by Reuters had projected an unemployment rate of 6.5%.

That comes after data released on Wednesday showed that Latin America's largest economy created a net 247,818 formal jobs in September, the most since February and above analysts' estimates of a net 227,600.

Brazilian President Luiz Inacio Lula da Silva and Finance Minister Fernando Haddad cheered the unemployment figures on Thursday in separate posts on X.

But the fact that Brazil's jobless rate has been hovering around historically low levels, and that job creation keeps surprising to the upside, is fueling market fears that the tight labor market could trigger inflationary pressures.

"This improvement takes place in a delicate macroeconomic environment, where inflation and the cost of credit may require a more intense response from the central bank in adjustments to the interest rate," Jefferson Laatus, chief strategist at Laatus Group, said.

"Especially if the increase in the number of workers puts pressure on consumption and makes controlling inflation difficult."

The central bank last month hiked its interest rate for the first time in more than two years, delivering a 25 basis-point increase to 10.75%.

Market participants have fully priced in an acceleration in monetary tightening, with a 96% chance of a 50 basis-point increase at the central bank's rate-setting committee's meeting on Nov. 6.

The remaining 4% probability is of an even larger increase of 75 basis points.

The number of unemployed in Brazil was 7.0 million in the July to September period, down 7.2% quarter-on-quarter. Employed citizens totaled 103 million, up 1.2% on a sequential basis and the highest ever for the data series, IBGE said.

Average real wages were at 3,227 reais ($559) a month in the period, the statistics agency added.

($1 = 5.7698 reais)