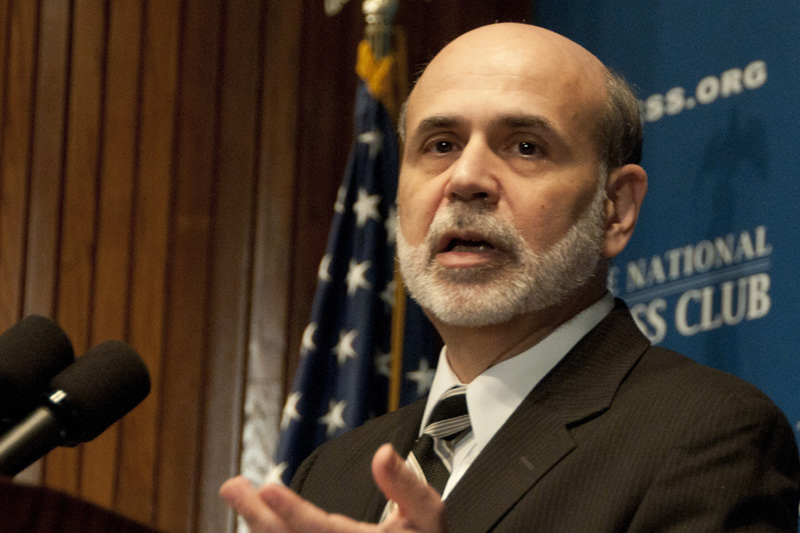

Investing.com - In prepared remarks released before his testimony to Congress later in the day, Federal Reserve Chairman Ben Bernanke said the pace of the central bank’s bond purchases are not a “preset course”.

"I emphasize that, because our asset purchases depend on economic and financial developments, they are by no means on a preset course," Bernanke said.

Bernanke reiterated that the Fed will continue to maintain its accommodative monetary policy for the foreseeable future.

He added that the central bank may taper its USD85-billion-a-month asset-purchase program later this year and halt it around mid-2014.

Bernanke said the pace of purchases could be maintained longer if conditions are less favorable.

Bernanke will testify before lawmakers at 10 a.m. Eastern time.

Following Bernanke’s comments, the U.S. dollar was little changed against the euro, with EUR/USD easing down 0.02% to trade at 1.3165.

Meanwhile, U.S. stock future indices were higher. The Dow Jones Industrial Average futures rose 0.1%, S&P 500 futures pointed to a gain of 0.3%, while the Nasdaq 100 futures pointed to an increase of 0.3% at the open.

"I emphasize that, because our asset purchases depend on economic and financial developments, they are by no means on a preset course," Bernanke said.

Bernanke reiterated that the Fed will continue to maintain its accommodative monetary policy for the foreseeable future.

He added that the central bank may taper its USD85-billion-a-month asset-purchase program later this year and halt it around mid-2014.

Bernanke said the pace of purchases could be maintained longer if conditions are less favorable.

Bernanke will testify before lawmakers at 10 a.m. Eastern time.

Following Bernanke’s comments, the U.S. dollar was little changed against the euro, with EUR/USD easing down 0.02% to trade at 1.3165.

Meanwhile, U.S. stock future indices were higher. The Dow Jones Industrial Average futures rose 0.1%, S&P 500 futures pointed to a gain of 0.3%, while the Nasdaq 100 futures pointed to an increase of 0.3% at the open.