By Wayne Cole and Swati Pandey

SYDNEY (Reuters) - Australia's economy slowed more than expected last quarter as consumers reacted to tepid wage growth by shutting their wallets, a disappointing outcome that sent the local dollar sliding as investors pushed out the chance of any rate hike.

The news came as fears of a possible slowdown in the U.S. economy and the Sino-U.S. tariff slugged world shares and threatened future business investment.

The gloomy report provides another blow to Australia's center-right government, which is already lagging in polls ahead of a likely election in May.

Wednesday's report on gross domestic product (GDP) showed the economy expanded 0.3 percent in the third quarter, half of what economists had expected. Second-quarter growth was unrevised at 0.9 percent.

Annual GDP rose by a still-respectable 2.8 percent to A$1.8 trillion ($1.32 trillion), but confounded expectations in a Reuters poll for a 3.3 percent increase.

The figures also imply growth in the year to June was 3 percent, rather than the originally report 3.4 percent.

The data will not be welcomed by the Reserve Bank of Australia (RBA), which predicts growth of around 3-1/2 percent this year and next.

"The RBA forecasts are now looking pretty optimistic," said Tom Kennedy, senior economist at JPMorgan (NYSE:JPM).

"You are seeing consumer spending pull back a little bit... There's not that much cash out there for consumers to spend to their discretion," he added.

"Wage growth is low and the household savings rate is also pretty low. You overlay that with the fact that housing is slowing means the wealth effect... is no longer supporting consumption."

The disappointing set of numbers sent the Australian dollar

MISERLY CONSUMERS

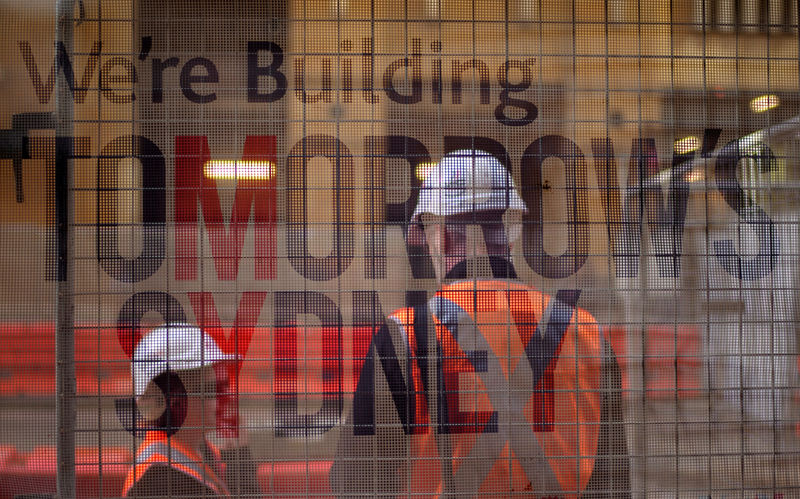

Australia's economy has generally outperformed its rich world peers in recent years and is in its 28th year of growth without a recession.

The performance owed much to Australia's ability to attract a surfeit of skilled migrants, which kept population growth at a rapid 1.6 percent a year.

Without that, GDP per capita rose a modest 1.2 percent in the third quarter.

A major drag in Wednesday's report came from private consumption, which added a mere 0.2 percent to growth after 0.7 percent in the June quarter.

An accelerating decline in Sydney and Melbourne home prices has eaten into consumer wealth at a time when they hold record levels of mortgage debt. A long stretch of unusually slow wages growth has also throttled household incomes, and shows little sign of changing anytime soon.

Indeed, the GDP report showed that while employers were taking on a lot of new workers they weren't paying them much more, so average wages rose by just 0.2 percent in the quarter.

This soft underbelly of the economy has become a concern for the Reserve Bank of Australia (RBA) and is one reason it kept interest rates at record lows of 1.5 percent this week.

Adding to the case for caution is the ongoing U.S. trade dispute with China, Australia's single most lucrative export market.

Thus while the RBA is still tipping economic growth of 3.5 percent this year and next, it shows no inclination to tighten anytime soon.

Futures markets <0#FF:> are now pricing in only a 20 percent probability of a hike by Christmas next year, down from 30 percent before the 0030 GMT GDP data release.