By Jonathan Leff

NEW YORK (Reuters) - Americans are more likely than ever to favor easing a ban on exporting crude oil, so long as it does not lead to higher gasoline prices that have recently sunk to near $2 a gallon, according to a new Reuters-IPSOS poll.

In questions posed to more than 2,000 voting-age Americans earlier this month, around 45 percent generally agreed that oil drillers should be allowed to export domestic crude abroad, while just over 30 percent broadly disagreed. In September, supporters and opponents were both at around 40 percent.

It was the first meaningful shift in opinion since Reuters-IPSOS began polling on the issue in October 2013. In the previous three surveys, respondents were generally split 50:50.

The poll does not explain why U.S. public sentiment has shifted. However, several events in recent months may have moved the needle on one of the nation's most pressing, if little-debated, energy policy issues.

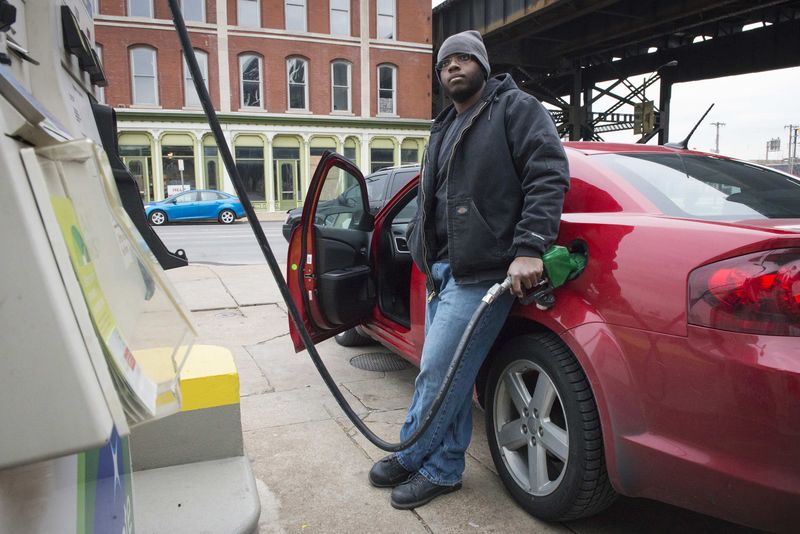

U.S. retail gasoline prices have halved to near $2 a gallon, probably easing immediate anxiety over pump prices; a growing number of public officials have spoken out in favor of exports, including Obama advisors; and U.S. export regulators significantly eased restrictions in December.

Signs of growing popular support for exports may encourage more politicians to take a clear stand on the issue, although most analysts do not expect significant action by either President Barack Obama or Congress in the near future.

For politicians, who otherwise support free trade and energy development, the biggest hurdle to rolling back legislation that critics say is a relic from the 1970s seems to be fear of being blamed if gasoline prices were to rise.

And indeed, American voters still remain largely opposed to exports under that scenario. Only around 22 percent of voters would still support exports if it meant higher gas prices, a figure barely changed from the previous survey.

Lifting the ban will not be welcome for refiners, such as PBF Energy Inc (N:PBF) and Alon USA Energy Inc (N:ALJ), who have benefited from cheaper domestic crude oil supplies.

Four refinery CEOs wrote to new Senate Energy and Natural Resources Committee Chairwoman Lisa Murkowski this week to remind her that replacing foreign crude with domestic shale oil had helped create "thousands of long-term, good-paying jobs".

MAINTAINING CREDIBILITY?

Over the past year, a host of studies from think-tanks and industry groups has sought to debunk the idea that exporting crude could inflate domestic pump prices. In fact, most say that easing the ban would actually make gas prices cheaper by adding more crude oil to the global market.

A growing number of officials - including some prominent Democrats - have also called for action.

Fully lifting the ban is the "correct policy decision," Tom Donilon, former National Security Advisor to President Barack Obama, said at a forum held by Columbia University's Center on Global Energy Policy last week.

"Lifting the ban will advance our economy, our energy future, and our foreign policy and national security goals. It is the next step in leveraging our energy posture to protect and to enhance U.S. leadership for years to come."

At the same event, former State Department official Carlos Pascual said the ban was hurting Washington's credibility on the international stage, particularly on related issues such as free trade, sanctions on Iran and even climate change.

"If the basic point is to say to countries that we have to (work) together to put global interests and concerns above short-term domestic action," Pascual said. "The only way to maintain credibility is if you do it yourself."