Investing.com - The U.S. dollar traded down against its major rivals, after Germany’s constitutional court approved the euro zone’s new bailout fund, while speculation that the Federal Reserve is set to embark on a third round of easing weighed on the dollar.

During U.S. afternoon trade, the dollar was lower against the euro, with EUR/USD rising 0.28% to 1.2891.

The ruling by Germany’s constitutional court will allow the country’s president to ratify the European Stability Mechanism under certain conditions and clear the way for the European Central Bank’s bond purchasing program to proceed.

Following the ruling, Eurogroup head Jean-Claude Juncker said the ESM's board of governors will hold their first meeting on October 8.

German Chancellor Angela Merkel welcomed the court’s verdict, calling it a good day for Germany and for Europe.

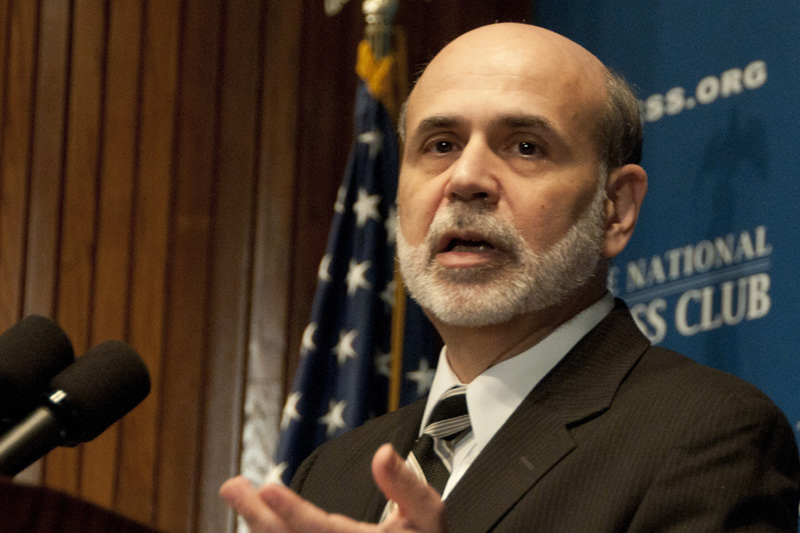

The greenback remained under broad selling pressure amid speculation that the U.S. central bank may implement a third round of quantitative easing after its upcoming policy meeting, which concludes on Thursday.

The greenback was also lower against the pound, with GBP/USD adding 0.25% to 1.6111.

The pound found support after official data showed that the number of people claiming unemployment benefit in the U.K. fell by a seasonally adjusted 15,000 in August, defying expectations for an increase of 500.

The unemployment rate ticked up to 8.1%, from 8.0% in July, compared to forecasts for an unchanged reading.

Elsewhere, the greenback edged higher against the yen, with USD/JPYrising 0.17% to hit 77.89 but was lower against the Swiss franc, withUSD/CHF sliding 0.10% to trade at 0.9382.

The greenback was broadly lower against its Canadian, Australian and New Zealand counterparts, with USD/CAD rising 0.27% to 0.9756,AUD/USD easing up 0.12% to 1.0447 and NZD/USD inching up 0.10% to 0.8180.

The dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, gave back 0.13% to 79.89.

In other news Wednesday, official data revealed U.S. import prices rose for the first time in five months in August, climbing 0.7% as fuel prices increased, but were still below expectations for a 1.4% increase.