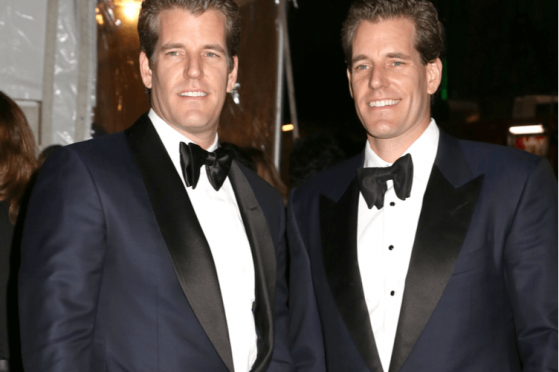

Gemini, the exchange that was founded by the Winklevoss twins, just announced a new service that would allow so-called “crypto whales” to make transactions in a faster-paced environment without clogging up the normal transaction traffic offered to regular traders on the platform.

The twins’ exchange isn’t the first to ever offer block trading services, as similar options have already been available via exchanges in Hong Kong and Australia because of the increased interest from large-scale investors in Bitcoin and a number of other cryptocurrencies.

“As part of our mission to continue to improve and expand our platform, we are excited to launch Gemini Block Trading, a fully electronic block trading facility. Block Trading enables our customers to buy and sell large quantities of digital assets outside of Gemini’s continuous order books, creating an additional mechanism to source liquidity when trading in greater size,” the exchange said in a blog post.

The service will be available to traders starting at 9:30 AM EST on Thursday.

Traders wishing to participate will have to either sell or buy a minimum of 10 BTC (over $67,000 today) or 100 ETH (just under $40,000 today).

Any information about a block trade will be published ten minutes after it is complete.

The only times these trades are not permitted is within 25 minutes of an auction on the platform.

Gemini’s block trading platform will help tamper some of the volatility of Bitcoin that is often caused by large haulers trading enormous sums, which sometimes destabilize the asset’s price.

There’s no word so far on whether the Winklevoss twins plan on expanding past Bitcoin and Ethereum.

They might do this, however, as Gemini recently announced that it is planning to expand its portfolio for 2018, adding a couple of altcoins to its primary offer.

This article appeared first on Cryptovest