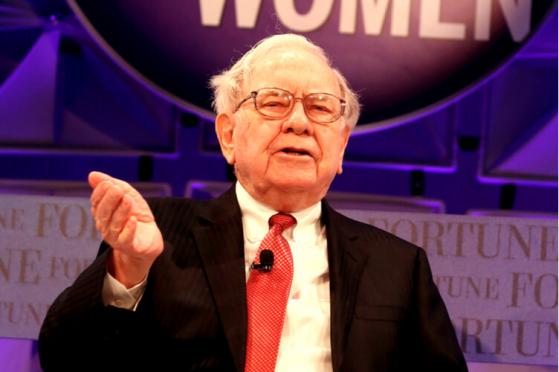

Martin Weiss, the founder of Weiss Cryptocurrency Ratings and Weiss Ratings, said on Thursday billionaire Warren Buffett was wrong to pronounce so harshly on cryptocurrencies at Berkshire Hathaway’s annual shareholder meeting last week.

Weiss was reacting to a statement by Buffett describing Bitcoin as probably “rat poison squared” and something creating no value whatsoever. However, Weiss countered that "many well-respected investment and financial experts seem to underestimate the tremendous benefits cryptocurrencies can provide in terms of speed, security, and decentralization."

He also offered three reasons why digital currencies provide significant value to the financial markets. According to him, digital assets provide intrinsic value in that they allow investors and users to obtain a share of a large distributed ledger technology (DLT) platform with exceptional computing power worldwide.

Cryptocurrencies also bring exchange value to the table given the proven track record of the space to grow and their expanding adoption in a wide range of transactions, both in exchange for fiat money and for goods or services.

Thirdly, certain cryptocurrencies could provide the foundation for a digital monetary system boasting greater stability and improved resistance to government manipulation.

Buffett, Charlie Munger rip into cryptos

During Berkshire Hathaway’s 2018 stockholders meeting, Buffett was joined by Charlie Munger and the duo pulled no punches with their criticisms on digital currencies. Buffett compared cryptocurrencies to collecting stamps, where value is determined at the individual level.

“The check is a wonderful idea, but it does not make the check intrinsically valuable,” he stated, adding he does not see any real commercial use of cryptocurrencies as an exchange of value.

Buffett also prophesied a grim future for the cryptocurrency space:

“Cryptocurrencies will come to a bad ending because nothing is being produced in the way of value from an asset. There is also a problem that it draws in a lot of charlatans who are trying to create exchanges or whatever it may be. It is something where people of less than stellar character see an opportunity to clip people who are trying to get rich because their neighbors are getting rich buying this stuff that neither of them understands. It will come to a bad end.”

The latest scathing review from the “Oracle (NYSE:ORCL) of Omaha” came a few days after he likened buying Bitcoin to gambling, with people buying the cryptocurrency in the hope that somebody else pays them more for it.

This article appeared first on Cryptovest