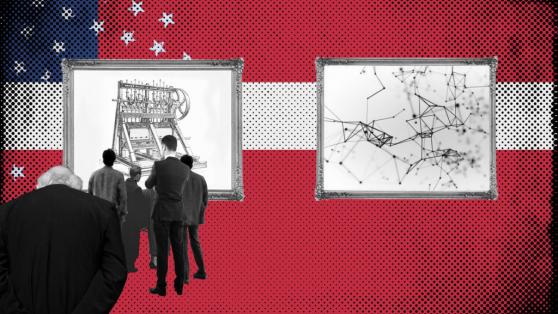

Late Monday afternoon, the U.S. Securities and Exchange Commission (SEC) made public its regulatory agenda for 2021. Conspicuously missing from its list of regulatory priorities for the year was any mention of cryptocurrencies, blockchain, or specific tokens such as Bitcoin or Ethereum.

The regulatory omission of crypto from the SEC’s possible policy punch list is surprising given recent news regarding cryptocurrency miner energy consumption, increasing ransomware attacks paid in Bitcoin, potential threat of private cryptocurrencies to sovereign currencies asserted by the International Monetary Fund and politicians, the IRS clampdown on capturing crypto scofflaws and more.

None of those topics made the regulatory “To Do” list for the top regulatory agency that oversees financing, banking, securities, and commodities trading markets. This is clearly good news for crypto bulls who no longer have a regulatory headwind for the remainder of the year.

This is an unexpected development for many market watchers because the chairman made repeated public comments, including a broadcast interview last month, where he stated that the cryptocurrency space needed oversight to protect investors.

“It’s a digital, scarce store of value, but highly volatile,” SEC Chairman Gary Gensler said, specifically regarding Bitcoin. “And there are investors that want to trade that, and trade that for its volatility, in some cases just because it has lower correlation with other markets. I think that we need greater investor protection there.”

However, in that same interview he did note a distinction between cryptocurrencies and unregistered securities merely posing as cryptocurrencies, which his agency will address.

He said:

“To the extent that something is a security, the SEC has a lot of authority. And a lot of crypto tokens — I won’t call them cryptocurrencies for this moment — are indeed securities".

The laundry list of items he wants the SEC to focus on in 2021 include:

- Disclosure relating to climate risk, human capital, including workforce diversity and corporate board diversity, and cybersecurity risk.

- Market structure modernization within equity markets, treasury markets, and other fixed income markets.

- Transparency around stock buybacks, short sale disclosure, securities-based swaps ownership, and the stock loan market.

- Investment fund rules, including money market funds, private funds, and ESG funds.

- 10b5-1 affirmative defense provisions.

- Unfinished work directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, including, among other things, securities-based swaps and related rules, incentive-based compensation arrangements, and conflicts of interest in securitizations.

- Enhancing shareholder democracy.

- Special purpose acquisition companies.

- Mandated electronic filings and transfer agents.

On the Flipside

- While Chairman Gensler has said his agency won’t pursue regulatory action against cryptocurrencies in 2021, last month he challenged Congress to initiate hearings and legislative steps to control cryptos.

- Gensler call to action has sparked no congressional action; however, Senator Elizabeth Warren has become vocally opposed to Bitcoin mining’s alleged negative impact on the environment. It remains to be seen if her rhetoric results in regulatory restrictions.

EMAIL NEWSLETTER

Join to get the flipside of crypto

Upgrade your inbox and get our DailyCoin editors’ picks 1x a week delivered straight to your inbox.

[contact-form-7] You can always unsubscribe with just 1 click.