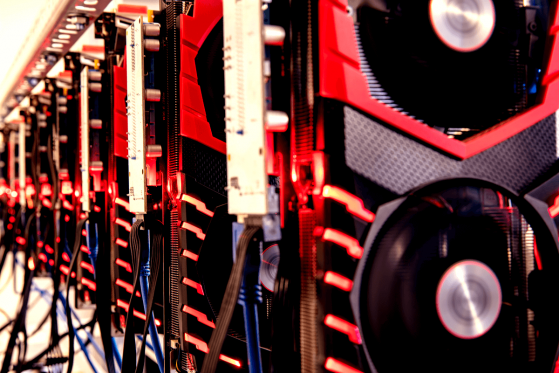

Nvidia’s financial results for the third quarter of 2018 came out worse than expected due to inventory overload caused by the end of the cryptocurrency boom, as stated in the official release.

The manufacturer of graphics products for the gaming industry experienced strong revenue growth in 2017, capitalizing on pent-up demand for chips from PC-based cryptocurrency miners. However, riding a hot trend may have adverse consequences once the market cools down.

“Our near-term results reflect excess channel inventory post the crypto-currency boom, which will be corrected," Nvidia founder and CEO Jensen Huang commented.

Third-quarter revenues grew 2% sequentially to $3.18 billion and 21% compared to the same period of 2017. However, investors were not hap...

This article appeared first on Cryptovest