(Bloomberg) -- Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

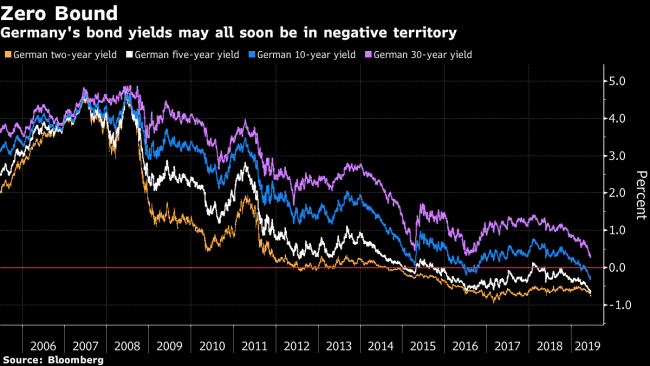

The last glimmer of positive yields on German bonds is in danger of being snuffed out.

Thirty-year yields turning negative would be a first among major bond markets, with a global rally already having sent all of Germany’s out to 20 years below zero. It may only take a further deterioration in trade relations between the U.S. and China, a flare-up of political risk or more hints of stimulus from the European Central Bank to turn the whole curve negative.

The impact could be far reaching. It may mean that insurers and pension funds are forced into buying negative-yielding debt, due to the need to maintain portfolios with high credit ratings. It will also push traders into more risky securities such as Italian, corporate or emerging-market debt to chase yields. And it’s another signal for Europe’s so-called “Japanification” where growth, inflation and bond yields stay depressed long-term.

“If you had asked me just two weeks ago about the prospect of 30-year German yields going below zero, I would have taken a couple of days to get over the laughing fit,” said Luke Hickmore, a money manager at Aberdeen Standard Investments. “Now, we seem to have transitioned to a completely different market environment with yields set to test more eye-watering lows and negative levels around the world. The significance is massive.”

The amount of bonds globally with negative yields surged to a record $12.5 trillion this week after ECB President Mario Draghi gave the clearest signal yet that the institution is weighing up interest-rate cuts and quantitative easing. He has joined the U.S. Federal Reserve and others in mooting renewed stimulus on the growing threats to global economic growth.

Germany only has six conventional securities out of 57 left that offer a positive yield in its 750 billion euro ($846 billion) market, all maturing in more than 20 years. This will make it harder for Europe’s economic powerhouse to resist boosting fiscal expenditure, since it effectively gets paid to do so, at a time when the European Commission is battling with Italy to reign in its spending.

“If that would not encourage them to borrow more and spend, I’m not sure what will,” said Kacper Brzezniak, a money manager at Allianz (DE:ALVG) Global Investors. “Frankly, right now, if I was the German finance ministry, I would issue bunds and buy Italian bonds.”

Giffen Good

Peter Chatwell, head of European rates strategy at Mizuho International Plc, described German 30-year bonds as a “giffen good,” defined as a product that people consume more of as the price rises. Investors who follow a benchmark index are likely to buy German bonds, while others may only be permitted to buy securities with a positive yield.

“For those investors who are mandated to hold a certain proportion of German paper, and particularly those who cannot buy negative-yielding paper, they have an ever narrowing window in which to buy,” Chatwell said. “Some real-money investors may well be forced to buy this scarce commodity of positive-yielding German paper.”

German 30-year yields currently provide a yield of 0.29%, having touched the lowest level on record this week. By comparison U.S. 30-year yields are at 2.54% and Italy’s still offer above 3%. Market pricing using options implies a roughly one-in-three chance that German 30-year yields will drop into negative territory over the next year, according to Bloomberg calculations.

Negative Europe

That would be one step further than Japan, where yields on 30-year bonds have never turned negative, touching a low of 0.02% in 2016 and offering 0.34% now. Only Switzerland has seen an entire yield curve in negative territory, but the size of its debt market is less than a 10th of Germany. The whole yield curve in Denmark is also close to going negative.

The Netherlands may follow, with its 10-year yields already negative. The equivalent French, Finnish and Austrian bond yields all dipped below zero this week. The growing stock of debt below zero may mean that insurers have to be stress tested for the impact of negative rates under the European Union’s Solvency II regulations in the future.

“There are many liability-driven investors in the world who are trying to buy long duration assets, and are finding that they still do not have enough,” said Aberdeen’s Hickmore.

(Updates yields throughout.)