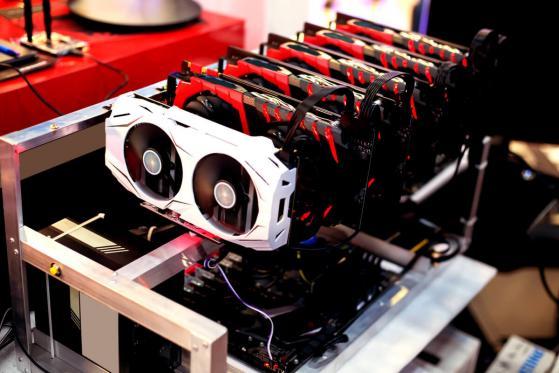

It’s going to be a tough couple of months for graphics card board manufacturers as interest in cryptocurrency mining is on the decline, at least according to statements by Capital Investment Management with regards to Gigabyte, one of the largest producers of graphics cards.

“The prices of major cryptocurrencies have plunged after peaking in early 2018 [...] leading to persistently lower demand for cryptocurrency mining and for Gigabyte graphics card shipments, which decreased somewhat since the beginning of the second quarter,” the company wrote in a note last week.

The lower demand, however, could be a positive news for gamers as graphics cards should return to normal prices.

Although one could never be absolutely sure, it appears that Capital Investment Management is concerned only by the demand for graphics cards, but not for mining equipment in general.

After all, ASICs have become more popular as mining some cryptocurrencies using GPUs is becoming more difficult. The hash power of Bitcoin network, for example, has almost entirely been taken over by these specialized chips.

With Bitmain working hard to develop mining rigs that work with algorithms that are traditionally ASIC-resistant, it can be expected that the share of hashing power from GPUs will diminish as people are discouraged by the low payouts that they get from mining pools.

A recent analysis of the Zcash network showed that almost 40% of its entire hashing power is already dominated by ASICs, not only making it vulnerable to a 51% attack but also making GPU mining pointless on an algorithm that was supposed to protect against this sort of thing.

“In our opinion, as the average selling price of graphics cards is expected to edge down, the second-quarter gross margin could underperform quarter-on-quarter,” Capital Investment Management said about Gigabyte.

K.J. Sun, a spokesman for the graphics card manufacturer, confirmed that motherboard sales would increase over the next quarter while card shipments are likely to drop. He did not provide reasoning beyond these statements.

As a result, cheaper GPUs can be expected over the next half of the year as ASICs start to take the center-stage in the cryptocurrency mining ecosystem.

This article appeared first on Cryptovest